Looking for a

Surefire alternative?

See why customers feel Shape is the better overall mortgage CRM.

|

||

|---|---|---|

| Lead & Sales Management | ||

| Partner Management & Referral Tracking

| ||

| Historic Status Date & Time Tracking

| ||

| Bulk Record Import & Update

| ||

| Marketing & Automation | ||

| Content Exchange

| ||

| Pre-Made Text & Email Templates

| ||

| Marketing Consent Opt-Out & Tracking

| ||

| Communication Tools | ||

| Voicemail Drop

| ||

| Local Presence Dialing

| ||

| Historic Omni-Channel Communication Log

| ||

| Mobile Accessibility & User Experience | ||

| Customizable Checklists

| ||

| In-App Prioritized Views

| ||

| Mobile-Optimized User Interface

|

Concerned about the moving process from Surefire to Shape?

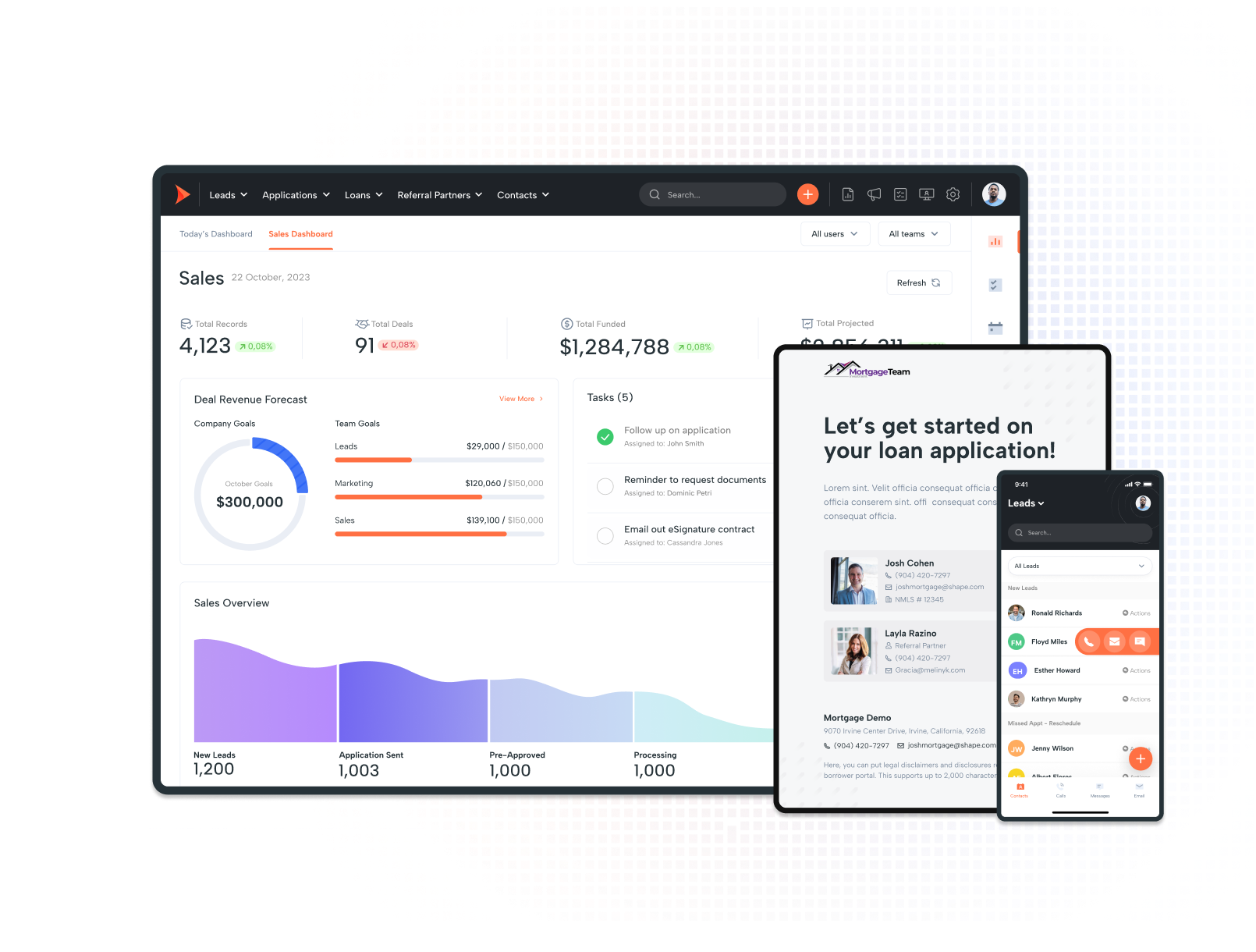

Shape is everything your mortgage company needs

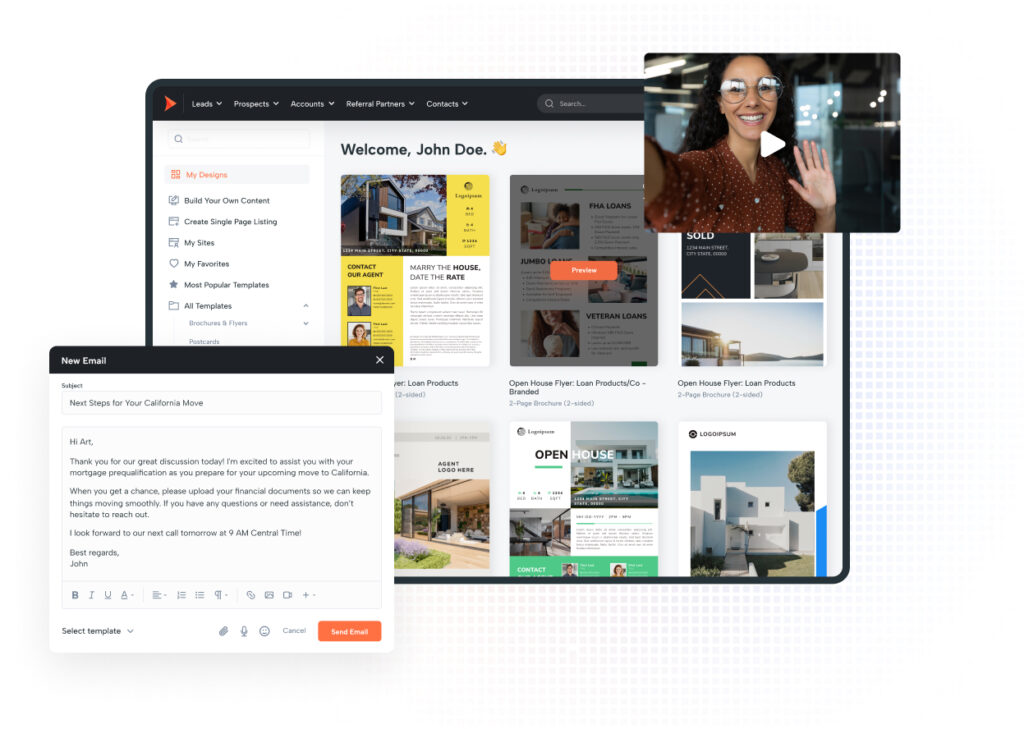

Unlock ready-to-use mortgage marketing content that drives results

Access thousands of data-driven, pre-made templates designed to close loans faster, with powerful sequences for every step of the loan process. From bulk and video messaging to emojis and GIFs, our tools help you engage clients and close more loans effortlessly.

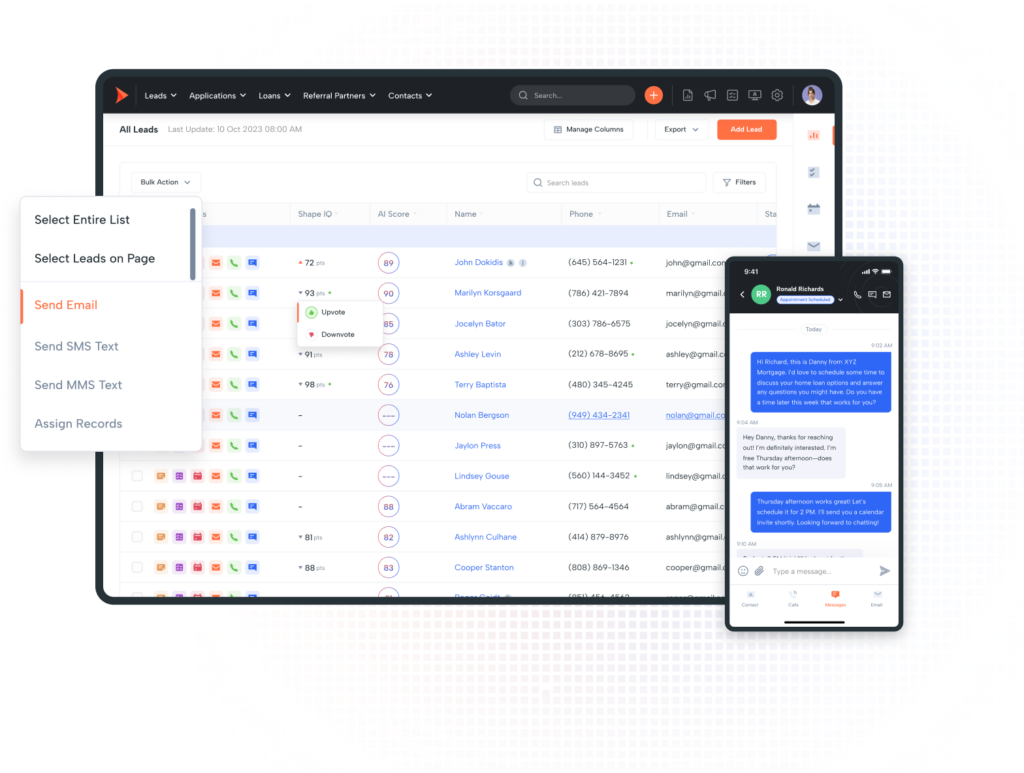

Maximize lead conversions with powerful lead management tools

Supercharge your lead management with QuickFire speed-to-contact, connecting borrowers to loan officers in seconds. Our AI lead scoring and prioritization rules bump top prospects to the front of the line, while state-based routing ensures compliance. Plus, our multi-object database allows LOAs and processors to collaborate effortlessly with LOs on client files, driving faster and more efficient loan closings.

Convert more leads with CRO-optimized lead funnels

Boost conversions with CRO-optimized landing pages, leveraging heat maps, A/B testing, and more to ensure maximum lead capture. Our survey-style lead funnels gather crucial qualifying details, and built-in scheduling tools automatically book appointments, all seamlessly integrated with your Shape Mortgage CRM.

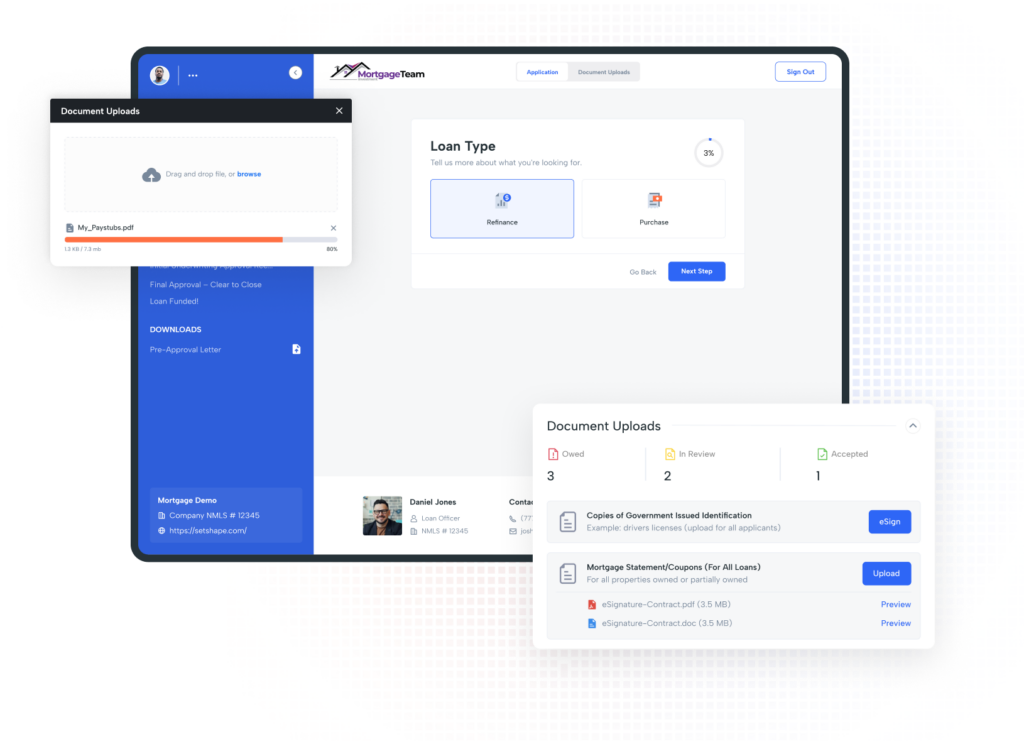

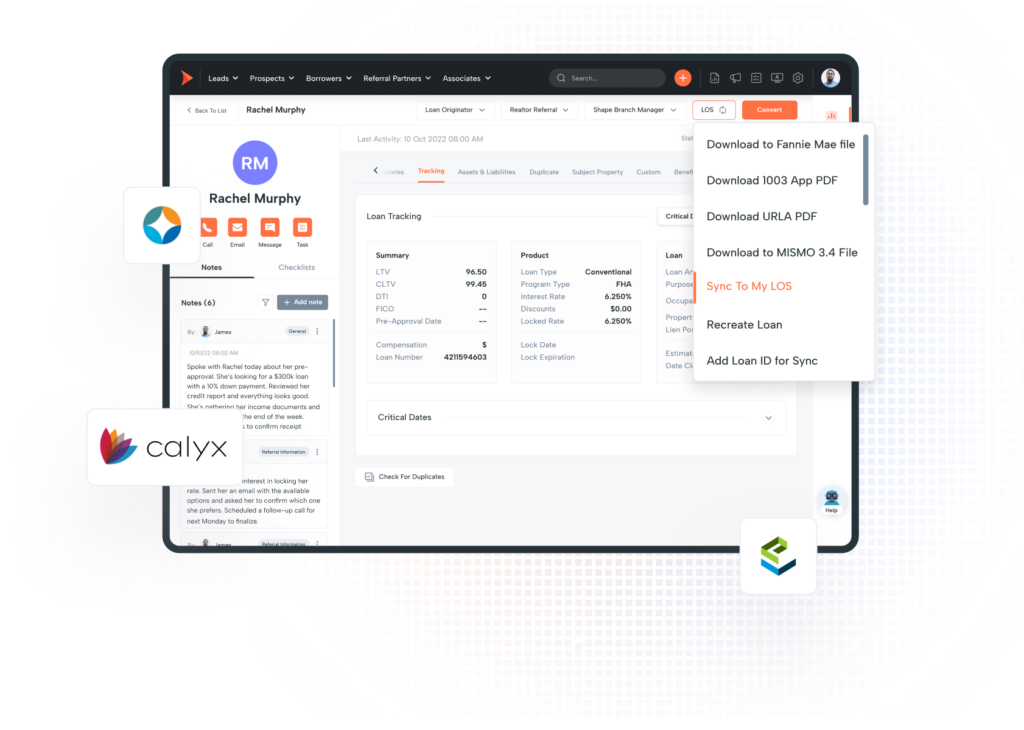

Streamline your mortgage process with our built-in point of sale

Optimize your mortgage process with our all-in-one borrower portal, built to collect digital 1003 applications and loan documents seamlessly converted to MISMO 3.4 and PDF. Automatically synced with your LOS solution, it eliminates the need for multiple logins or tabs, streamlining your workflow for maximum efficiency.

Track realtor referrals with powerful referral partnership management

Strengthen your B2B relationships with integrated referral partner tracking, co-branding, and templated checklists. Easily identify top referrers, use advanced prioritization rules to follow up on key partnerships, and automate workflows with marketing journeys to nurture relationships. Maximize your business potential and ensure partnerships continue to thrive.

Eliminate manual effort with seamless LOS APIs and milestone updates

Leverage our native LOS integrations with Encompass, LendingPad, and LendingDox for seamless loan management, with automatic updates on assignments, transaction data, and milestones. Stay on top of every stage with automated follow-ups to borrowers, referral partners, agents, and transaction coordinators, keeping everyone informed and eliminating manual efforts.

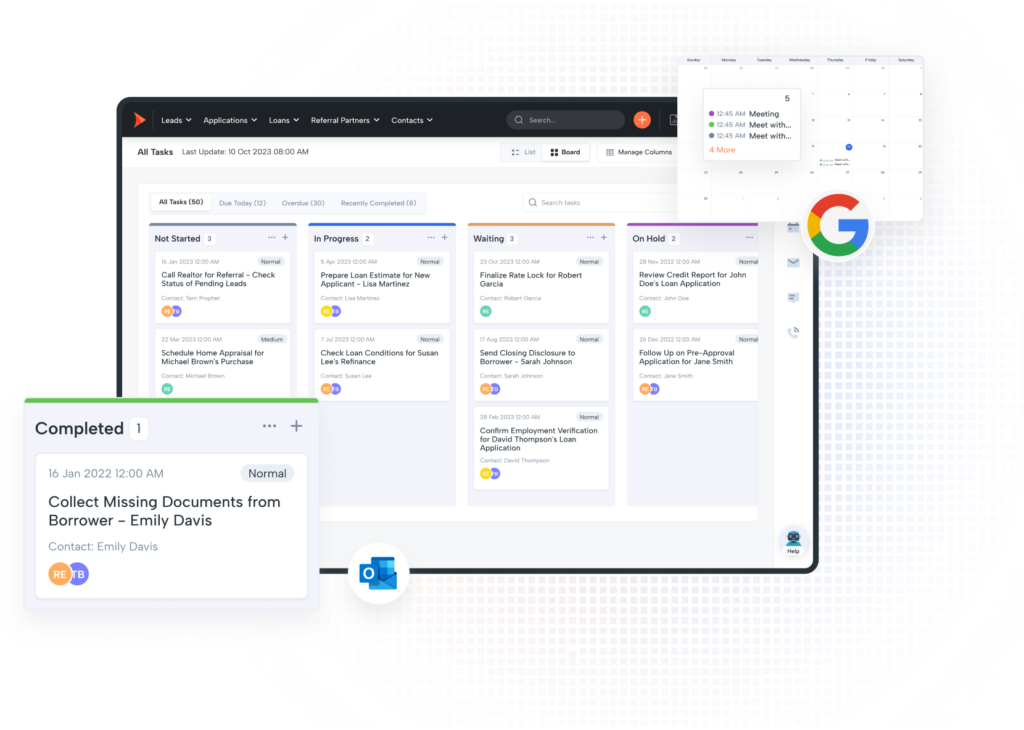

Manage tasks and sync your calendar with Google and Outlook

Stay on target with our task management solution, enabling you to create one-off or templated tasks with scheduled cadences and checklists for efficient organization. Our calendar syncs one-way or bi-directionally with Google or Outlook, ensuring seamless integration with your email calendar.

Shape vs Surefire better scalable

CRM alternative

Breaking down Shape vs Surefire

Shape Software and Surefire both offer CRM solutions for sales and marketing, but their capabilities vary significantly. Shape Software is a fully integrated all-in-one platform that provides customizable sales workflows, built-in communication tools, advanced marketing automation, and mobile-first accessibility. In contrast, Surefire lacks key sales management, automation, and VoIP capabilities, requiring third-party integrations and expensive add-ons for basic CRM functions. Shape is built for scalability, automation, and seamless team collaboration, ensuring that businesses operate more efficiently without additional software or hidden costs.

Shape automatically records lead status updates with timestamps, allowing sales teams to analyze progress and optimize their follow-up strategy—while Surefire does not provide any status history tracking.

Shape helps businesses comply with marketing regulations by tracking customer consent for outreach, while Surefire offers only limited consent-tracking capabilities, increasing compliance risks.

Shape allows users to send pre-recorded voicemails and display a local area code on outbound calls, increasing engagement rates, whereas Surefire requires an additional Power Calls add-on for these features.

Shape enables teams to create structured task checklists and prioritize lead views based on urgency, helping streamline workflows—features that Surefire lacks in both desktop and mobile versions.

Surefire CRM provides basic sales tracking and marketing automation, but it lacks key lead management, customization, and communication features that modern businesses need. Many of Surefire’s core functionalities require third-party add-ons, making the platform less scalable and more expensive over time.

Surefire includes a set of pre-made templates for customer outreach, but lacks Shape’s advanced automation tools for email and SMS personalization.

Surefire does not offer integrated calling tools, meaning users must pay extra for a Power Calls add-on to access click-to-call, voicemail drop, and call tracking.

Surefire has limited database segmentation options and does not support referral tracking or multi-object database functionality, making lead organization more rigid.

Unlike Shape, Surefire does not provide in-app calling, texting, or advanced mobile lead views, making on-the-go sales management more difficult.

Get started with Shape today