The best mortgage websites all boil down to one question: which one helps you close more loans. We’ve tested everything from button colors, images, and calls-to-action, to wording and even the proper number of fields to answer this question. Others can argue what looks best or what they think will work until they’re blue in the face, but you can’t argue with data. We’ve tested hundreds of landing pages and websites, with tens of thousands of leads and our clients have closed billions of dollars of loans with our websites. And unless you want to replicate the same tests, this article discusses some of the things we’ve learned, and that come pre-built, with every Lead Engine website we offer.

Lead Engine websites are all optimized with everything discussed in this article and more, including future A/B split testing and optimization every month. Instead of paying a conversion rate optimization (CRO) company $10,000-$15,000 per month to constantly run different tests, and then a web development team even more money to work on your website – we offer pre-built best-in-class mortgage websites that are continually optimized for just $300 per month.

For the sake of suspense, here is the list from 11 to 1.

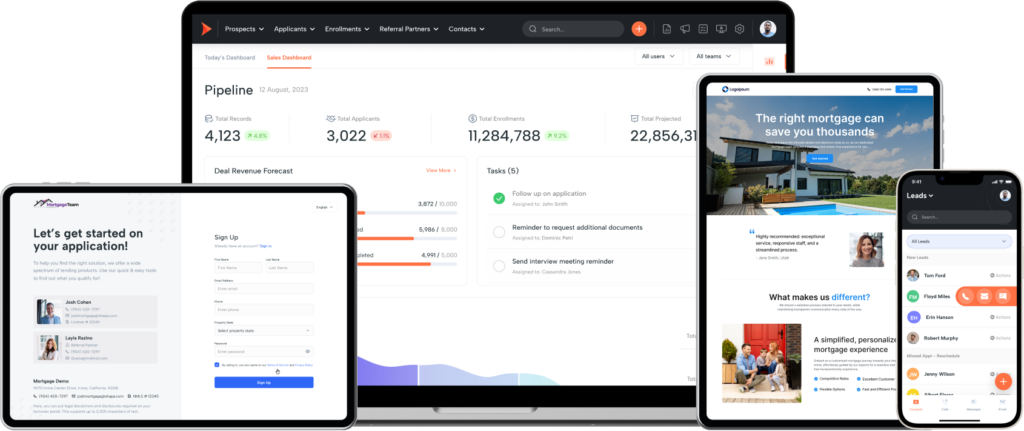

Over 50% of internet traffic is done on mobile devices and if your website isn’t responsively designed to show up on mobile and other devices, the negatives to your business can be pretty scary. ~80% of people that visit a non-mobile friendly website on their mobile device will leave and go to a competitor’s website, according to Google. Imagine 80% of your mobile site visitors leaving! Google has also outright said that mobile-friendliness is a priority in their SEO ranking of a site. If your site isn’t responsively designed for mobile you’re not only making it hard on your users and clients, you’re shooting yourself in the foot with lower visibility in search results and impacting your organic traffic and SEO.

Using a Lead Engine website guarantees a positive mobile user experience and reduces your bounce rates, improving your lead conversions.

Have you ever landed on a website and immediately realized it’s not-professional or not-worthy of your business? Well your clients have too – and you don’t want to have that website. Most people just skim websites so having the proper navigation, design, color themes and other details that might seem small to you – can actually have the most massive impact on your website, and bounce rates. Having the proper spacing, image vectors, fonts, and even button sizes can impact your conversions.

Pro tip: Instead of finding, hiring, and working with a designer, web developer, UI/UX expert (and then paying them all!), then spending months testing different versions of your site, use a Lead Engine website and save thousands of dollars and a countless amount of time that could be spent closing more loans.

If your website isn’t optimized to load fast, you’re losing business, Google is dinging you for it, users are leaving your site, and your conversions are being hurt by it. Here is the data behind what is hurting your business with slow loading times:

Back in the day content was king regarding websites, then it was videos, and now it’s tools. Providing free tools that users can interact with provide the user engagement and personalized information that enhances their experience and helps convert them. With potential borrowers it helps build trust and increases the time they spend on the site which establishes credibility and increases the likelihood of conversions. Still not a believer that a mortgage calculator is essential for your mortgage website? Here are some data points you can’t argue with:

Don’t want to spend the time building a mortgage calculator and properly placing it on your website? Neither do 78% of all mortgage websites according to a study by Ellie Mae that showed nearly 80% didn’t have a mortgage calculator. Save time and stand out using a Lead Engine optimized mortgage website with a built-in mortgage calculator today.

Properly displaying a section with reviews and testimonials on your mortgage website can increase conversion rates as much as 270% according to a study by Spiegel Research Center. Shape’s Lead Engine websites have tested the types of review displays (stars, ratings, etc.) positioning of reviews and styles to optimize websites that convert leads and closed deals the most. Trust, as it relates to a mortgage firm is vital to establish the credibility needed to convert leads, appointments, and closed deals.

Sometimes the most efficient way to handle a borrower or lead is to not handle them at all. Instead of scheduling time on your calendar or playing phone tag until you are able to speak with each other chewing up your valuable time, many of your borrowers can be pre-screened for eligibility using a chatbot. Remember, the best mortgage website helps you convert more closed loans, not more leads. A chatbot can assist with answering (and asking!) relevant questions to guide borrowers down the right path to save you time and help you close more loans. Having a built-in chatbot can increase conversion 20% or more but making sure the right prompts, answers, and built-in AI are provided are the keys to increased conversions with one.

Most loan officers spend thousands on leads, SEO, and driving traffic to their website and because they make the simple mistake of not having proper CTA structure they miss out on deals. If your borrowers aren’t ready to start the application process, then it’s imperative that you either schedule a meeting with them or gather their information so you can reach out to them at a future time. For example, certain landing pages and websites that have a CTA form prominently at the top of the page convert over 302% more according to our tests.

With our Lead Engine websites, every call-to-action form, button, and digital mortgage application has been thoroughly tested and optimized.

One of the most important things to getting a closed loan is the first conversation. While online applications, e-mails, texts and chatbots are essential tools – the phone still reigns king when it comes to the mortgage industry. Your competitive advantage as a loan officer is you. Your credibility, your ability to execute, your personality, your likeability are all things that can only be conveyed by speaking with potential borrowers. And leading your website traffic down a proper funnel to booking an appointment to speak with you is vital to the success of your website. What information you ask for, where you embed your calendar, what dates and times you make available are all imperative schedule more higher quality conversations. With every Lead Engine website we’ve perfected the way your borrowers schedule appointments. From providing personalized information like your picture and signature, to setting up the calendar (which can sometimes be a technical challenge), we’ve got your back.

A digital mortgage application or point-of-sale is basically a self-serve application that assists you in gathering all the required information and documents needed to complete a mortgage application. Providing an option for your clients and potential borrowers to finish a mortgage application right from your website is one of the most important aspects to having a good mortgage website. If you don’t have one you may as well be living in the stone age, using a fax machine, or relying on email back-and-forth to get your borrowers to complete mortgage applications.

As we mentioned at the beginning of this article, the best mortgage websites are those that help you close more loans. Properly posting leads into your CRM and having the proper sales and marketing automation including emails, texts, and phone calls is quite possibly the most important component of having a good mortgage website. Your website, POS, and CRM need to all work together as a closed loop to continually feed into each other as the real lead engine, until you close a deal. And even after you close a deal, your CRM’s post close marketing should be setup to bring back more deals as your closed clients refinance in the future, send you referrals, and generate you more business over the years.

The mortgage industry is constantly changing and in order to stay competitive you must always continually test. Interest rates rise and fall, purchase business and refinance business ebb and flow, referral traffic and SEO always change. With a Lead Engine website, you become the beneficiary of thousands of tests that are constantly being ran, so that you are always on the cutting edge. A standard conversion rate optimization company will charge upwards of $15,000+ per month just to run tests (and usually it’s worth it). With a Lead Engine website, we provide the same level of testing and it’s included with every website. As artificial intelligence, web optimization, and marketing tactics evolve over the years, so will your website.

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.