FinLocker offers the solution to empower lenders to provide their customers with personalized financial solutions and a path to homeownership.

FinLocker provides users with the tools and resources they need to achieve their financial goals and embark on the path to homeownership. The platform's comprehensive capabilities, from credit monitoring and budgeting to personalized homeownership journeys, make it an invaluable resource for consumers and financial institutions alike.

Empowerment: FinLocker is committed to empowering consumers by providing tools and resources that help them take control of their financial lives. The platform emphasizes financial literacy and self-sufficiency, enabling users to make informed decisions about their finances and homeownership.

Innovation: At the core of FinLocker is a drive for innovation. The company integrates advanced technologies and data analytics to create personalized financial journeys for users. This approach ensures that consumers receive tailored advice and actionable insights based on their unique financial situations.

Security: FinLocker prioritizes the security of user data. The platform employs bank-level security measures, including AES-256 encryption, to protect personal and financial information. This commitment to security builds trust with users and ensures that their data is handled with the utmost care.

Inclusivity: FinLocker aims to make financial fitness and homeownership accessible to a broad audience. The platform supports individuals at various stages of their financial journey, including those who are financially challenged. By offering comprehensive tools and educational resources, FinLocker helps users improve their credit, save for down payments, and achieve their financial goals.

Customer-Centricity: FinLocker values its partnerships with financial institutions, mortgage lenders, credit unions, and housing counselors. The platform is designed to enhance customer relationships by providing a branded, private-labeled experience that reflects the values and objectives of its partners. This approach ensures that consumers receive consistent and personalized support from their trusted financial advisors.

Financial Health Monitoring: FinLocker provides users with real-time access to their credit scores, credit reports, and credit monitoring services powered by TransUnion. This capability allows users to track their credit health, receive alerts about changes, and make informed decisions to improve their creditworthiness.

Comprehensive Financial Management: The platform offers a consolidated view of users' financial accounts, including banking, credit cards, loans, and investments. This single-pane-of-glass view helps users manage their finances more effectively by providing a clear picture of their overall financial health.

Spending Analysis and Budgeting: FinLocker's proprietary spending analysis tool categorizes transactions and provides visual summaries of spending patterns. Users can create custom budgets, set savings goals, and track their progress towards achieving financial milestones, such as saving for a down payment.

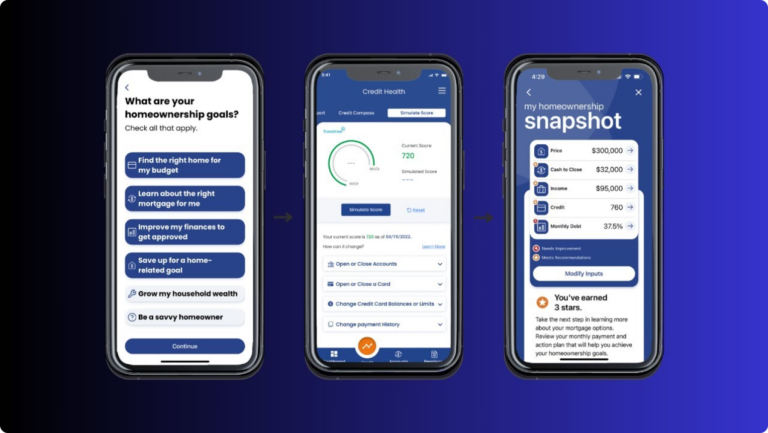

Credit Improvement Tools: The platform includes an interactive credit simulator that helps users understand the impact of their financial decisions on their credit scores. By exploring different scenarios, users can make strategic choices to enhance their credit profiles and improve their eligibility for mortgage loans.

Personalized Homeownership Journeys: FinLocker guides users through personalized, data-driven journeys towards homeownership. The platform analyzes financial data to provide tailored action plans that help users become mortgage-ready. This includes improving credit scores, saving for down payments, and managing debt-to-income ratios.

Home Affordability Calculations: Advanced analytical tools within FinLocker calculate affordable home budgets based on users' income and financial goals. The platform provides recommendations for monthly mortgage payments and savings targets, helping users plan for homeownership more effectively.

Educational Resources: FinLocker offers an extensive library of educational content, including videos and articles on topics such as mortgage processes, home buying, and credit management. These resources help users build their financial knowledge and prepare for the responsibilities of homeownership.

Secure Document Storage and Sharing: Users can securely store and manage personal and financial documents within FinLocker. The platform's patented sharing process allows users to transmit encrypted data and documents to their lenders, streamlining the mortgage application process and ensuring data security.

Ask About the Shape + Finlocker API Integration

"*" indicates required fields

Website

Company Info

Year Founded 2014 St. Louis, Missouri, United States

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.