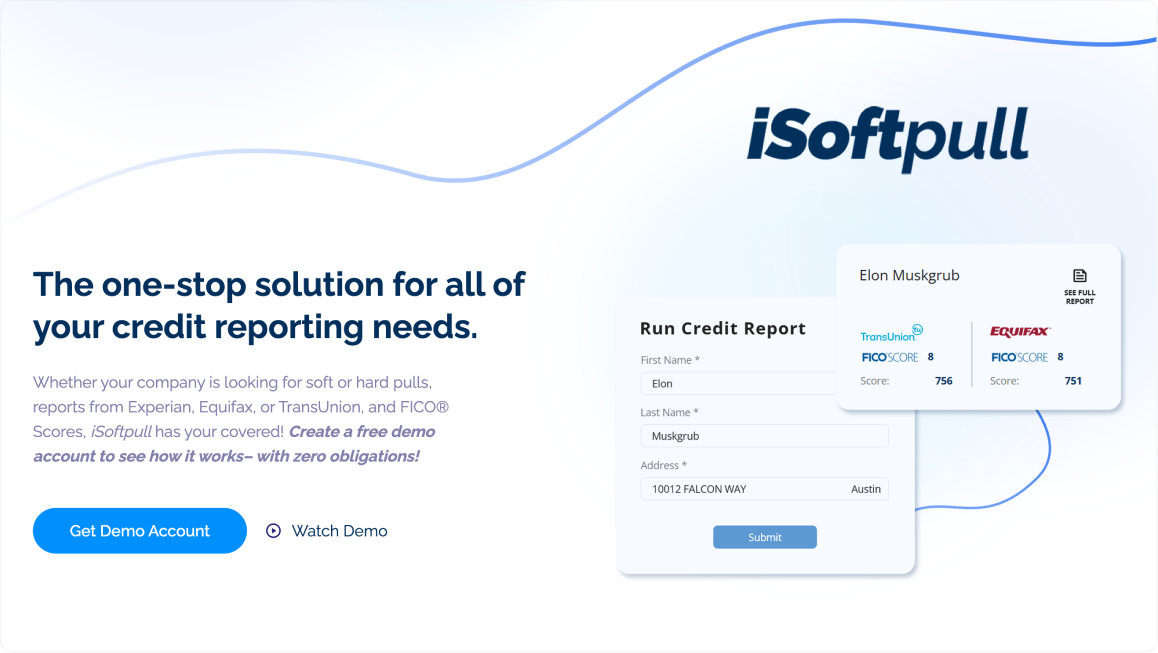

iSoftpull emerges as a leader in reliable tools to assess creditworthiness, offering innovative solutions that streamline the credit evaluation process.

iSoftpull is a cutting-edge credit reporting platform designed to assist businesses in pre-qualifying clients without impacting their credit scores. As an authorized reseller of major credit bureaus—Equifax, TransUnion, and Experian—iSoftpull delivers full credit reports and FICO® Scores using only the client's name and address, eliminating the need for sensitive information like Social Security numbers or dates of birth.

Soft Credit Checks: Access full credit reports and FICO® Scores without affecting the client's credit score. Utilize only the client's name and address, ensuring a hassle-free process.

Integration Suite: Automate business processes with easy-to-implement credit reporting APIs. Seamlessly integrate iSoftpull into existing systems for enhanced operational efficiency.

Credit Webforms: Create customizable pre-qualification webforms that display credit-relevant messaging based on the client's exact FICO® Score. Embed these forms on your website to streamline client onboarding.

Credit Intelligence: Leverage proprietary technology to provide instant pre-qualification decisions based on custom credit score tiers. Enhance decision-making with accurate and timely credit insights.

Identity Risk Suite: Protect your business from synthetic identity fraud with advanced fraud detection tools. Ensure secure transactions and maintain client trust.

Income Analysis Suite: Obtain predictive income intelligence appended to the client's credit report. Assess the client's financial capacity more comprehensively.

Instant Credit Evaluation: Receive immediate access to full credit reports and FICO® Scores, enabling quick and informed decision-making.

Simplified Process: Utilize only the client's name and address to obtain credit information, reducing the need for sensitive data and expediting the evaluation process.

No Impact on Client's Credit Score: Perform soft credit checks that do not affect the client's credit score, encouraging more clients to undergo pre-qualification.

Cost-Effective: Save on expenses associated with hard credit pulls by pre-qualifying clients at a fraction of the cost.

Enhanced Security: Protect your business and clients with advanced fraud detection and identity verification tools.

Ask about Shape + iSoftpull API Integration

"*" indicates required fields

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.