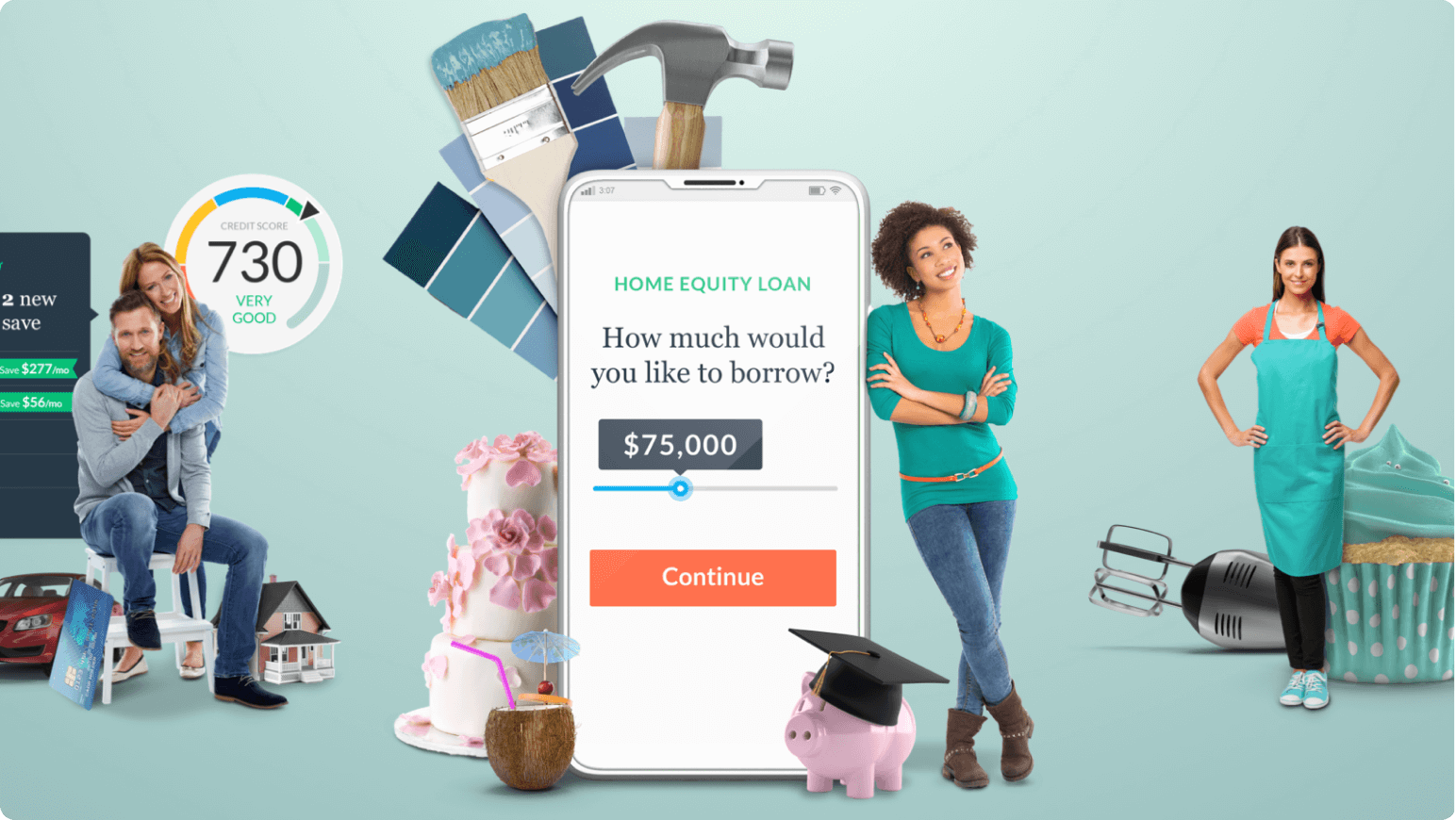

LendingTree invented online mortgage lead marketing. Most consumers already know LendingTree. We’ve built a trusted brand that converts your ideal customers into genuine prospects.

At LendingTree, we empower businesses to thrive with our advanced lead buying solutions. As a leader in the financial services industry, LendingTree connects lenders with high-quality, ready-to-convert leads.

Access to High-Quality Leads: LendingTree provides access to a vast network of high-intent consumers actively seeking financial products and services. Our platform ensures that you connect with potential clients who are genuinely interested in your offerings, increasing your chances of conversion.

Advanced Targeting and Segmentation: With LendingTree's advanced targeting and segmentation tools, you can tailor your lead buying strategy to match your ideal customer profile. Filter leads by demographics, credit score, loan amount, geographic location, and more to ensure you're reaching the right audience.

Real-Time Lead Delivery: LendingTree offers real-time lead delivery, allowing you to engage with potential clients immediately. This instant connection increases the likelihood of conversion and helps you stay ahead of the competition by responding to leads as soon as they express interest.

Comprehensive Lead Management: Our intuitive lead management system makes it easy to track, manage, and prioritize your leads. With detailed insights and analytics, you can monitor lead performance, measure ROI, and optimize your lead buying strategy for better results.

Seamless Integration: LendingTree integrates seamlessly with your existing CRM and marketing tools, enabling a streamlined workflow and enhanced productivity. Our integrations ensure that your lead data is automatically synced with your systems, eliminating the need for manual data entry.

Flexible Pricing Models: We offer flexible pricing models to fit your budget and business needs. Whether you prefer a pay-per-lead or subscription-based model, LendingTree provides customizable options that allow you to maximize your investment and achieve your marketing goals.

Increased Conversion Rates: By connecting with high-intent consumers actively searching for financial solutions, LendingTree helps you achieve higher conversion rates. Our platform ensures that you're reaching an audience that's already interested in your products, making it easier to close deals.

Cost-Effective Marketing: LendingTree's flexible pricing models allow you to control your marketing spend and focus on the leads that matter most. Our pay-per-lead model ensures you only pay for the leads you receive, making it a cost-effective solution for businesses of all sizes.

Enhanced Targeting Precision: With advanced targeting options, LendingTree enables you to reach your ideal audience with precision. This targeting capability reduces wasted efforts on unqualified leads and improves your overall marketing efficiency.

Streamlined Operations: Integrate LendingTree with your existing systems for a seamless lead management experience. Automate lead distribution and follow-up processes to enhance productivity and free up your team to focus on closing deals.

Legal Risk Mitigation: The company's tools are built to mitigate legal risks by providing proof of consumer consent. This is particularly important in sectors where regulatory compliance is critical, such as financial services, insurance, and home services.

Scalable Solutions: Whether you're a small business or a large enterprise, LendingTree's scalable solutions can adapt to your needs. As your business grows, our platform provides the flexibility to adjust your lead buying strategy and expand your reach.

Ask Us About the Shape + LendingTree API Integration

"*" indicates required fields

Website

Company Info

Year Founded: 1996 in Charlotte, NC

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.