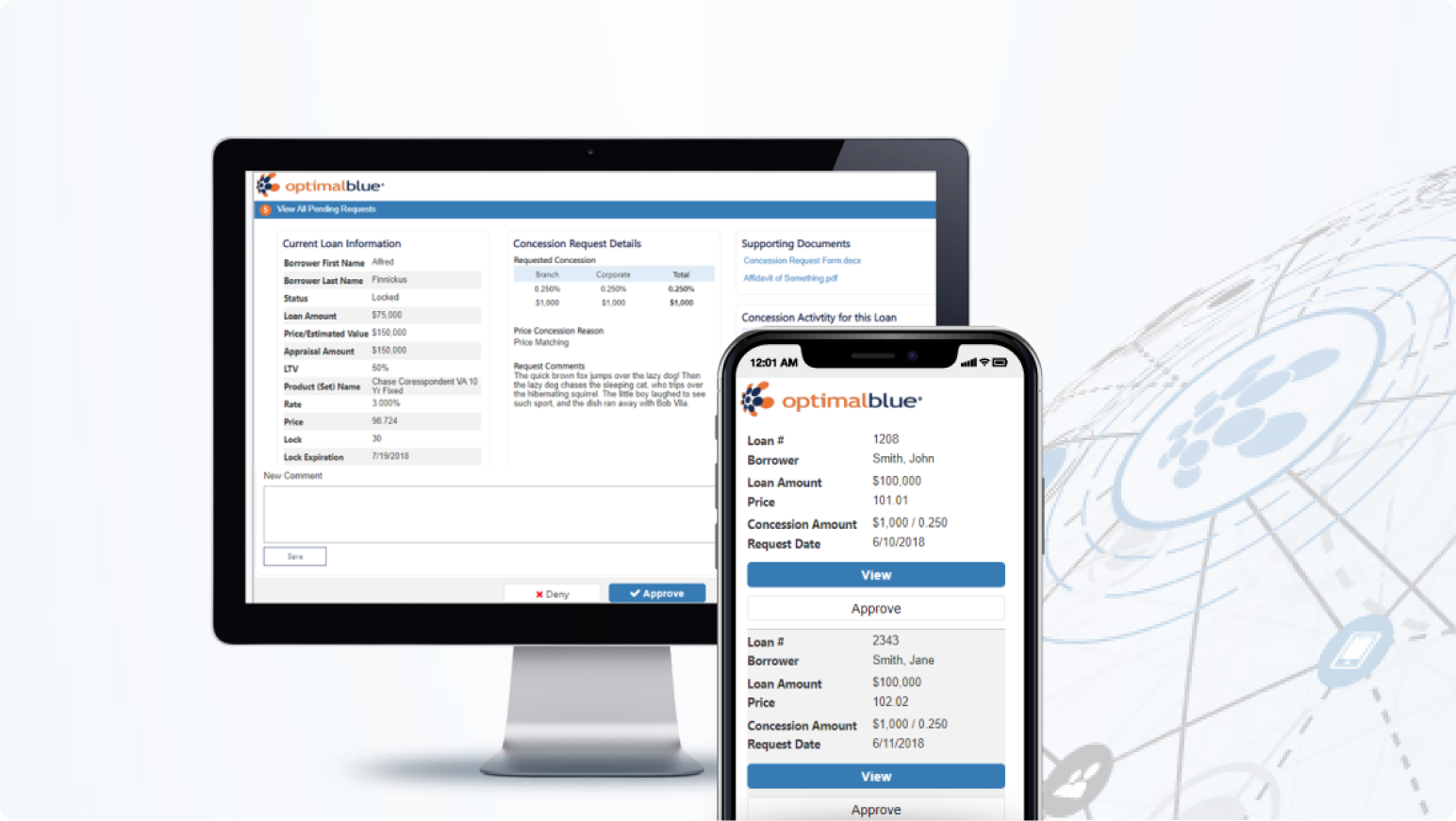

Optimal Blue provides a comprehensive end-to-end capital markets platform that bridges the primary and secondary mortgage markets through automation, data, and connections.

Optimal Blue is a leading provider of secondary marketing automation solutions, renowned for its robust, end-to-end capital markets platform. This platform serves as a bridge between the primary and secondary mortgage markets, offering a suite of integrated solutions designed to enhance efficiency, compliance, and profitability for mortgage lenders and investors.

Innovation: Optimal Blue is committed to developing cutting-edge technologies that streamline complex mortgage processes. Their continuous investment in innovation ensures that clients can leverage the latest advancements in automation and data analytics to stay competitive in the market.

Efficiency: The company prioritizes operational efficiency by providing tools that automate critical functions such as pricing, hedging, trading, and compliance. This automation reduces manual effort, minimizes errors, and accelerates transaction processes, allowing clients to focus on strategic decision-making.

Data-Driven Decision Making: Optimal Blue places a strong emphasis on actionable data. Their solutions offer real-time insights and comprehensive analytics that empower clients to make informed decisions, optimize pricing strategies, and improve overall market performance.

Compliance: In an industry heavily regulated by compliance standards, Optimal Blue offers robust compliance automation tools. These tools help clients navigate the complexities of regulatory requirements, ensuring that all processes adhere to legal standards and mitigate compliance risks.

Customer Focus: Client satisfaction is at the core of Optimal Blue’s values. The company provides tailored solutions to meet the unique needs of each client, offering exceptional customer service and support to help clients achieve their business goals.

Secondary Marketing Automation: Optimal Blue’s secondary marketing solutions automate key functions like product pricing, loan locking, and margin management. Their platform supports a wide range of mortgage products and investor types, making it a versatile tool for lenders.

Hedge Analytics and Loan Trading: The company offers advanced hedge analytics and loan trading capabilities. These tools enable clients to manage pipeline positions, mitigate interest rate risks, and maximize profitability on loan sales. The interactive trading environment also facilitates efficient loan transactions between buyers and sellers.

Data and Analytics: Optimal Blue provides a comprehensive suite of data solutions, including enterprise analytics, competitive benchmarking, and market data licensing. These solutions offer deep insights into market trends, pricing performance, and competitive positioning, helping clients optimize their strategies.

Investor Management: The platform includes features for investor management, such as marketplace access, counterparty oversight, and prospect marketing. These tools help clients promote investor content, streamline due diligence processes, and conduct market research to identify new opportunities.

Compliance Automation: Optimal Blue’s compliance automation tools cover social media compliance, monitoring, audits, and publishing. This ensures that all digital communications adhere to regulatory standards, reducing the risk of non-compliance.

Connection and Integration: The platform offers extensive integration capabilities with leading technology vendors, providing turnkey and custom API connections. This network enhances operational efficiency by allowing seamless integration of Optimal Blue’s solutions with clients’ existing systems.

Comprehensive Support: Optimal Blue supports clients with a wide range of resources, including best practices, educational content, and industry insights. Their resource center offers white papers, case studies, webinars, and daily market briefings to keep clients informed and empowered.

"*" indicates required fields

Website

Company Info

Year Founded 2002 Plano, Texas, United States

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.