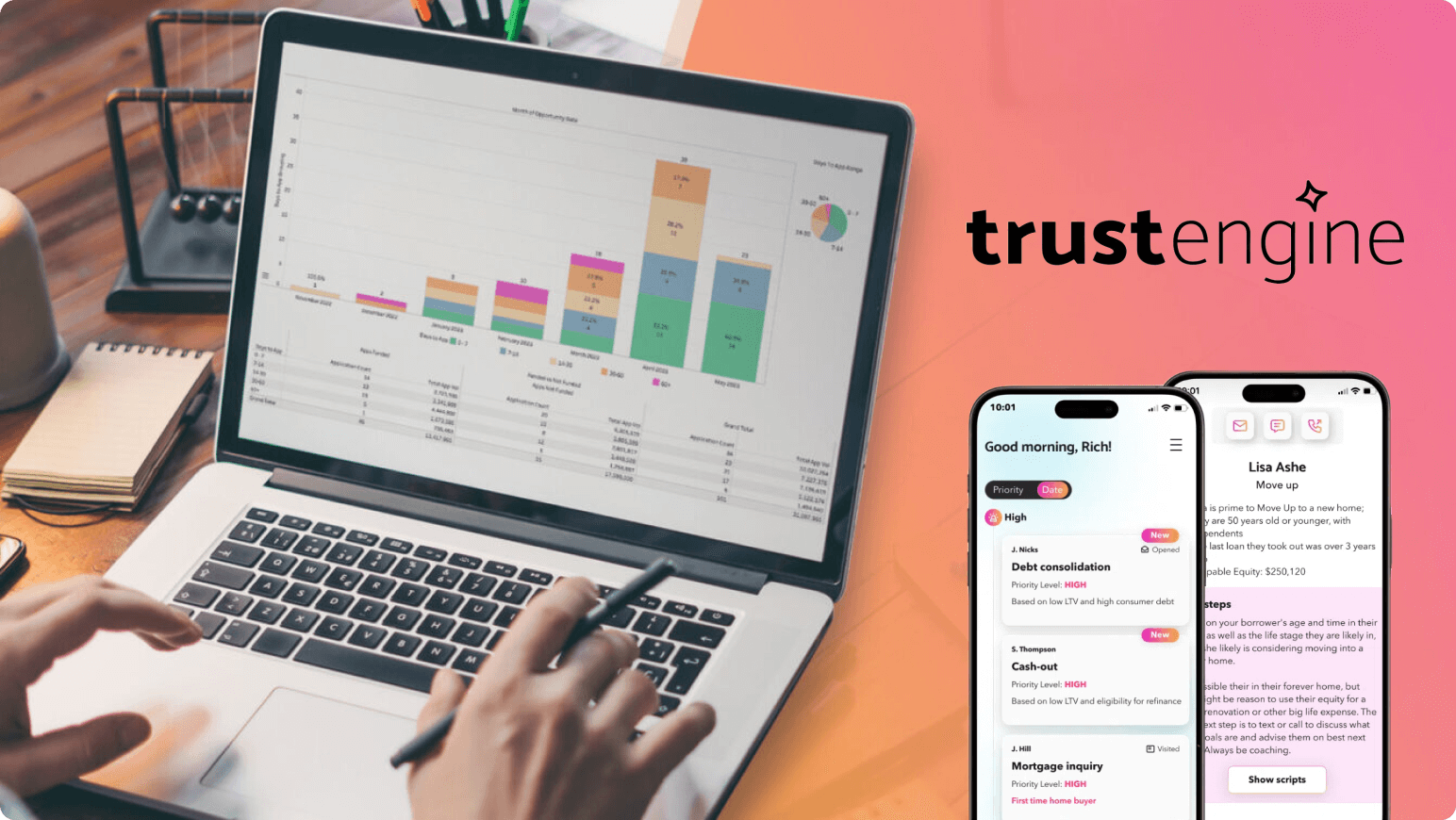

TrustEngine is a borrower intelligence platform for lenders, leveraging data, technology, and expertise to optimize lender and borrower success by identifying opportunities, powering borrower education, and increasing loan conversions.

TrustEngine stands at the forefront of the lending industry, providing an advanced borrower intelligence platform designed to enhance both lender and borrower experiences. By leveraging cutting-edge data analytics, technology, and industry expertise, TrustEngine identifies targeted opportunities that transform into meaningful conversations, ultimately driving borrower education and facilitating the closure of more loans.

Data-Driven Insights: TrustEngine prioritizes the use of precise data and analytics to understand borrower behaviors and market trends. This data-centric approach ensures lenders can make informed decisions, identify potential borrowers, and personalize their engagement strategies to meet individual needs.

Technological Innovation: Embracing the latest technological advancements is a core value of TrustEngine. Their platform integrates seamlessly with existing systems, offering features like automated borrower alerts and advanced financial impact assessments. This commitment to innovation allows lenders to stay ahead in a competitive market.

Customer Success: The success of their clients is paramount. TrustEngine provides robust support, training, and resources to ensure that lenders can fully leverage their tools. The focus on customer success extends to delivering tangible results, such as increased loan volumes and improved borrower retention rates.

Transparency and Trust: Building and maintaining trust with both lenders and borrowers is central to TrustEngine’s mission. By providing clear, transparent insights and fostering honest communication, they aim to create a more trustworthy lending environment.

Educational Empowerment: Empowering borrowers through education is a key component of TrustEngine’s values. Their tools are designed to help borrowers understand the financial implications of their loan options, promoting informed decision-making and fostering long-term financial well-being.

Borrower Intelligence Platform: TrustEngine’s primary offering is its Borrower Intelligence Platform, which combines data analytics and predictive modeling to identify high-potential borrowers. This platform helps lenders to optimize their outreach efforts and increase conversion rates by targeting the right prospects at the right time.

Sales Boomerang: A core feature of TrustEngine, Sales Boomerang, provides real-time borrower alerts, enabling lenders to react swiftly to borrower activities and needs. This tool ensures lenders can offer timely and relevant loan products, enhancing the overall borrower experience.

Mortgage Coach: TrustEngine’s Mortgage Coach tool is designed to educate borrowers about the financial impact of different loan options. This feature supports the creation of personalized loan scenarios, helping borrowers to make informed choices and improving their confidence in the loan process.

Integration and Compatibility: TrustEngine’s platform integrates smoothly with various lender systems and technologies, ensuring that clients can maximize their existing technology investments. This capability is crucial for lenders looking to enhance their operational efficiency and deliver better services without overhauling their current infrastructure.

Performance Marketing: The platform includes performance marketing tools that help lenders to track and optimize their marketing efforts. By providing detailed analytics and reporting, TrustEngine enables lenders to measure the effectiveness of their campaigns and adjust strategies to achieve better outcomes.

Comprehensive Support and Training: TrustEngine offers extensive support and training resources through their Support Center and TrustEngine University. These resources include live training sessions, on-demand video content, and a community platform for peer support, ensuring that lenders can fully utilize the platform’s capabilities.

Ask About the Shape + Trustengine API Integration

"*" indicates required fields

Website

Company Info

Year Founded: 2017. Trustengine was born from a merger of Sales Boomerang and Mortgage Coach.

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.