Get started with Shape today!

All-in-one software for marketing, sales, customer service, CRM, and operations.

Share article

14 Tips for Generating Free Mortgage Leads

-

Katherine Campbell

Tired of cold calling and getting dead leads? Well, we're here to help! This article provides a highly detailed analysis of advanced strategies for generating free mortgage leads, balancing cost-efficiency with amazing results. We cover both sides of the spectrum: from strategies for acquiring top-tier leads through top lead generation companies to methods for generating leads at no cost.

Our focus is on practical, proven tactics that can enhance your lead acquisition and conversion processes, crucial for growth and stability in the mortgage sector. Ideal for businesses seeking to optimize their marketing budget, this guide offers insights into integrating both digital and traditional approaches to expand your client base in a highly competitive market.

Let's get started!

Contents

- 1. Can you put a price on a stellar lead gen strategy?

- 2. How do loan officers generate free and low-cost mortgage leads?

- 3. What's the difference between paid and free mortgage leads?

- 4. 14 ways to get free mortgage leads

- 4.1. Ramp up your referrals

- 4.2. Pick up the phone

- 4.3. Learn to love pop-bys

- 4.4. Invest in quality Facebook ads

- 4.5. Be socials

- 4.6. Maximize social proof

- 4.7. Get physical

- 4.8. Keep it personal with video

- 4.9. Get your face on the fridge

- 4.10. Teach like you mean it

- 4.11. Create raving fans

- 4.12. Unlock the power of email marketing

- 4.13. Go through your mortgage analytics with a fine-tooth comb

- 4.14. Invest in an SEO-optimized blog

- 5. The main takeaway for generating mortgage leads? Simple – Invest in technology!

Can you put a price on a stellar lead gen strategy?

According to the dozens of expensive lead comparison sites like Bankrate, LendingTree and Zillow—heck yes, you can!

Whether it’s live transfer leads, trigger leads or anything in between, if you’re looking to bring in a steady source of online leads for your lending business, you may have to put some serious cash on the table.

That being said, low-cost and free mortgage leads are the smart business owner’s alternative to spending money on lead generation companies. While the latter can be effective, it can also be extremely costly and risky. Some of the downsides include:

- Expensive upfront and pay-per-lead fees

- Inconsistent lead quality

- Volatile customer acquisition costs

- Limited control over targeting

- Dependency on external providers

Conversely, using end-to-end technology like Shape Software to effectively field, manage, and service your leads is the ultimate way to get the most bang for your buck. Designed specifically to satisfy the growing needs of the industry, Shape's Mortgage CRM offers a sophisticated solution for mortgage businesses, enhancing lead generation through efficient conversion funnels.

This platform streamlines lead acquisition by integrating automated marketing software, enhancing both lead volume and quality. Its capacity to seamlessly meld with your existing marketing strategies translates into improved lead nurturing and conversion rates.

How do loan officers generate free and low-cost mortgage leads?

Loan originators utilize various strategies to generate leads. Before we get into the meat of this article, here's a quick run down of the key methods:

1. Networking

Loan originators often build relationships with real estate agents, financial advisors, and other professionals in the industry who can refer clients to them. More than others, the mortgage industry is built on relationships, meaning effective networking is often one of the best ways to generate free mortgage leads.

2. Digital marketing

If you want to generate high quality, free mortgage leads, having a great online presence is must. They may create a professional website, use search engine optimization, (especially local SEO) techniques to improve their visibility in online searches, and run targeted ppc adds to attract new mortgage leads. Today, staying competitive means investing digital marketing is non-negotiable. When it comes to understanding your target market, and hooking prospective customers, it is the foundation for most effective marketing plans.

3. Social media marketing

Loan originators can leverage social media platforms to connect with potential clients and share valuable content that positions them as experts in their field.

4. Referrals

The bread and butter of high quality free mortgage leads - satisfied clients often refer friends, family members, or colleagues to loan originators who provided them with a positive experience.

5. Lead generation services

Some loan originators may purchase leads from lead generation companies that specialize in lead generation for the mortgage industry. We'll cover this in more detail at the end of the article.

6. Community involvement

Participating in local events and organizations allows loan originators to establish themselves as trusted members of their community and potentially generate free mortgage leads through word-of-mouth referrals.

What's the difference between paid and free mortgage leads?

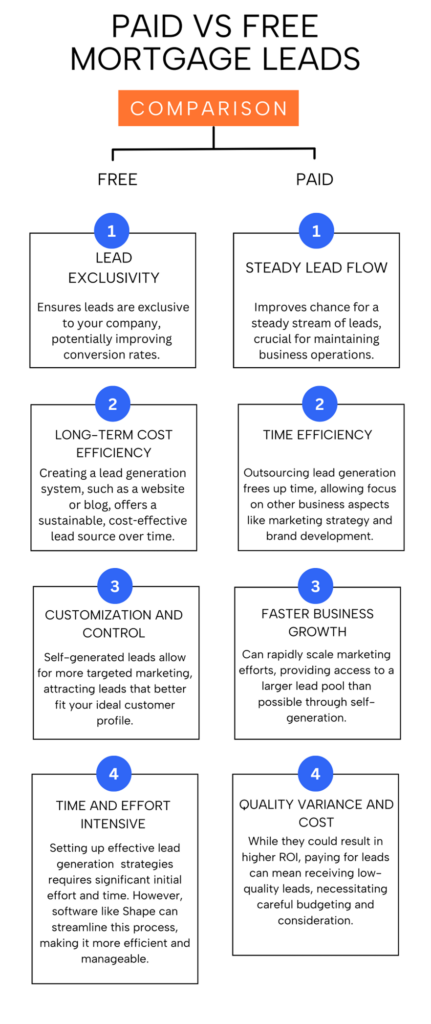

When it comes to lead gen strategies, loan officers face a choice between paid and free methods. Paid leads typically involve a financial investment, such as purchasing lists or paying for advertising, and often promise quicker results. Conversely, free and low-cost leads rely on organic methods like networking, referrals, content marketing, and SEO. These require more time and effort but are more cost-effective, and usually have a larger upside in the long run.

14 ways to get free mortgage leads

In order to facilitate a steady flow of cost-efficient leads, it's important for loan originators to employ a combination of strategies. These must be based on their target audience and business strengths in order to consistently generate good leads.

If you’re not sure where to start, don’t sweat it. We’ve rounded up actionable tips from some of the best originators in the biz.

Let's get to it!

1. Ramp up your referrals

We know you know this, but be honest: Are you really nurturing your referral network like you should?

According to the National Mortgage News Top Producer Survey, the top 3 best referral sources are:

- Past clients

- Real estate agents

- Past client database

And if you ask #1 best-selling author and CEO of Inc 500 Company Arcus Lending, Shashank Shekhar, he’ll tell you it’s time to double down on your efforts to connect with past clients.

“The lowest cost and the highest quality leads are always referrals from your past customers,” says Shashank. And that means having a rock-solid lead management system in place. “Database management by staying in touch and constantly providing value to them should always be a Loan Officer’s #1 goal,” he stresses.

Did you hear that? Consistently offering value should be your #1 goal.

Want to make the above a reality? Shape's Mortgage CRM is here to truly take your referral network to the next level! The software offers efficient contact management and operation streamlining, crucial for maintaining strong communication with past clients and partners. Shape's specialized tools for the lending industry, like automated sales and marketing efforts, can boost productivity. Its mortgage POS feature allows referral partners and agents to track and engage with their referrals actively. This integration of technology into your referral strategy can lead to better mortgage lead generation and business growth.

2. Pick up the phone

Here’s one we know you’ve heard before.

But in today’s digital age, the temptation to avoid the phone is all too real. In fact, according to a report by LivePerson 73% of millennials and Gen Z’ers interact with each other more digitally than they do in real life.

And while email, text and chatbot messengers may be great tools for engaging a new generation of homebuyers, experienced originators like Rhonda DelSignore-Mulligan say the phone is still #1.

“I’ve never been a big ‘lead’ person. You have to weed through them and there’s no guarantee of quality. I’m more about warm referrals from past clients, friends, family and partners in my referral network,” she says. As the Senior Mortgage Advisor at Province Mortgage Associates Inc., Rhonda’s on the phone with her referral partners every single day.

“Nothing’s better than an army of people spreading your name around. To me, that’s the best lead source,” she says.

3. Learn to love pop-bys

Yes, really.

According to Alex Jimenez, Branch Manager at Benchmark Home Loans and one of The Most Connected Mortgage Professionals of 2018, pop-bys still matter.

“Pop-bys always brings out the creative side in people. I love seeing the ideas that people can come up with to remind people that they are open for business,” says Alex.

In this day and age, pop-bys might seem a little old school. But Alex is known for his no-bull advice for cutting through the noise and figuring out what really works in the mortgage business. If he says pop-bys are worth your time, believe him.

Ready to step up your pop-by game? According to Alex, “Pinterest is a great source for some awesome pop-by ideas.”

4. Invest in quality Facebook ads

Facebook ads are widely hailed as the holy grail of low-cost mortgage leads.

But (and that’s a big BUT), experts like Marc Demetriou warn there’s an art and science to doing them right.

Marc’s an influential author, Certified Divorce Lending Professional and the Branch Manager at Residential Home Funding Corp. He’s also a big fan of Facebook ads as a low-cost lead source.

“Facebook targeted ads are the best way to get free or low-cost leads moving forward,” he says. And when we asked him how to win with Facebook ads?

It’s all about “good content vs. bad.”

We’ve all seen the flashy, overly-salesy Facebook ads and needless to say, they don’t inspire trust.

Quality content is key to getting quality leads from Facebook. And experts like Shashank agree. “For paid low-cost leads, Facebook advertising is still the best source. But don’t try to sell them rates, offer them something of value like a free eBook, a Webinar/Seminar and use effective value-added drip campaign so that they select you when they are ready,” he advises.

5. Be social and attract potential borrowers

According to industry veterans like John Stevens, the primary pressure today is to “be less personable and more digital.”

John is the immediate Past President for The National Association of Mortgage Brokers (NAMB) and has over a decade-long track record of success in the lending business. “One of the best ways to leverage your sphere of influence, and by default gain more leads, is to utilize social media,” says John.

Social media is everywhere and the pressure to be in all places at once is very real. Not only that, the 2016 State of Social Media in the Mortgage Industry report found a clear correlation between revenue performance and social presence, leaving originators with a serious case of FOMO if they’re not active on every platform.

But John warns that social media should never be a “set it and forget it” endeavor. Pick the one or two platforms where you know you can stay active and focus on engaging your audience.

“Share about what you do 1-2 times a week and be active in online boards discussing real estate and lending. Don’t be afraid to comment on a post where someone is looking for a home and let them know what you do! The key word to social media is ‘Social’. Use it,” advises John.

6. Maximize social proof

Let’s face it. For the mortgage industry, winter is coming.

Interest rates are going up, affordability is going down. Add a recession to the mix and you’ve got all the makings of a down market. And when the market goes down, originators need to push their value up.

According to Rajin Ramdeholl, Vice President Private Client Division at Meadowbrook Financial Mortgage Bankers Corp., that means hitting the gas on your know-like-trust factor.

“Loan officers can prove their value through social media videos or testimonials from prior clients. Or through online reviews,” says Rajin.

90% of consumers read online reviews before visiting a business. And with the number of non-exclusive leads hitting the market each and every day, you better believe the difference between you and the originator next door will come down to the number of stars next to your profile pic.

7. Get physical

Sometimes the best method for getting low-cost or free mortgage leads is to simply go left when everyone else goes right.

“No street level originator will ever be able to compete with the mega tech companies like Zillow, Rocket, Guaranteed Rate, etc. But they can’t compete with you doing things for your referral partners and asking for the business. We need to take the fight to our battleground, not try to fight on their battleground. As street level originators, we need to fight on a street level.”

Those words of wisdom are from Frank Garay, mortgage industry ace and co-founder of the National Real Estate Post.

“Use technology that helps you physically engage with referral partners by giving you a real reason to speak with them on a consistent basis asking them for the business. Not technology designed to ensure you don’t need to engage with them physically,” Frank suggests.

That means for most MLOs, it’s time to “Get back to physically ‘asking for the business’ from literally everyone you come in contact with.”

Because AI can do a lot of things, but delivering a firm handshake isn’t one of them.

8. Keep it personal with video

Speaking of standing out, the lending landscape is changing fast.

Big companies, big data and big tech are improving the customer mortgage experience in ways we never dreamed of. So what can you do to set yourself apart?

Communicate in the way no tech mammoth ever could: personalized video.

“Responding to customers questions via video and screen capture video most creative ways to create a memorable customer experience,” says Anthony VanDyke, President of ALV Mortgage and one of National Mortgage Professional Magazine’s Most Connected Mortgage Professionals of 2018.

“Mortgages involve a lot of numbers. It’s hard to type an email reply showing just numbers or speak to a customer on the phone speaking in numbers. Using video and visualization really help customers understand and see the numbers to help them make the best decision for their loan options,” he says.

Today, data shows video marketing is one of the most powerful tools there is – few methods are better at engaging and informing your target audience.

9. Get your face on the fridge

Speaking of putting faces to names, did we mention that some of the old school tactics still work?

Rhonda DelSignore-Mulligan gets tons of business from a simple 3-part mailing campaign:

- A greeting at the beginning of the year

- A sports calendar

- A magnet for the fridge

“People miss the boat on the human connection. They’re busy analyzing their lead sources and forget to reach out by mail or pick up the phone. But things change all the time in this business. Someone may have lost their job and need to get back to a 30-year fixed. You’ll never know if you don’t reach out directly,” says Rhonda.

Connecting with people is an often underestimated way of getting home loan leads free. By putting her face where her customers can always see it, Rhonda is the first person they think of when they need help with a mortgage or refi.

10. Teach like you mean it

Here’s the truth:

“In terms of leads, they either cost money or time so no free leads. If you are looking to spend more time generating leads and less money then building relationships and continuing to invest in those relationships yields the best quality leads with the least amount of money.”

John Thomas tells it like it is.

The Branch Manager of Primary Residential Mortgage, Inc. is one of the The Most Connected Mortgage Professionals of 2018 according to National Mortgage Professional Magazine. And he has the numbers to back it up. John has over 3,800 Facebook friends and 500 YouTube videos with 338 subscribers.

According to him, “Staying in front of your past clients with a good CRM, a phone call at least twice a year, and birthday program of sending a birthday card is a simple strategy to remain top of mind. Adding a client event such as a wealth builder workshop every quarter adds value and keeps you in front of them. Building relationships with business partners such as Realtors, financial planners, and CPAs is another great way to spend little money to generate very good quality leads. Teaching classes to these business professionals is a great way to provide value and stay top of mind.”

No matter which way you cut, all of John’s best lead gen strategies come down to one key tactic: Teaching.

“Another great strategy that will cost a little bit more money but can yield very good leads is a quarterly or monthly home buyer seminar,” says John. As a professional, you have knowledge and experience that is literally worth its weight in gold.

Share it with your audience and the leads will respond in kind.

11. Create raving fans

In addition to using pop-bys as a creative way to keep in touch with your past clients and community network, Alex Jimenez believes LOs must keep it genuine.

“Stay in front of your sphere of influence. Be in constant communication with people who have worked with you. Create ‘raving fans.’ In order to do that you have to have a genuine interest in people. You should know things like their kid’s names, spouse and even dogs. You should acknowledge large events taking place in their life, i.e., Bdays, anniversary dates, graduations, holidays, etc,” he suggests.

Winners like Alex know details matter. If you don’t already have a system for storing and tracking these important details, you should get one…like now.

“Stop being transactional, start being relational and the leads will come,” Alex concludes.

We couldn’t agree more.

12. Unlock the power of email marketing

“A small list that wants exactly what you're offering is better than a bigger list that isn't committed.” – Ramsay Leimenstoll.

Haven't got the budget to invest heavily in digital advertising? Customized email marketing could be your answer! This dynamic tool for mortgage lenders engages and converts leads into valued customers. Key to this strategy is crafting emails that speak directly to the aspirations and needs of potential homeowners. Segmenting your email list allows for targeted and relevant communication, and personalization should extend beyond mere use of names to tailor content to each recipient's unique mortgage journey. Content like market trends and loan approval tips transforms each email into a valuable resource.

Using automation tools simplifies this process, ensuring timely follow-ups and consistent engagement. The design of your emails is also crucial, with a focus on clean layouts and engaging visuals, coupled with clear calls to action. Analyzing campaign performance through open and click-through rates helps in continuously refining your strategy. With Experian reporting that email marketing can yield an ROI of $5 to $51 for every $1 spent, this approach is not just effective but also cost-efficient, solidifying email marketing as a powerful tool within the industry.

13. Go through your mortgage analytics with a fine-tooth comb

“Everybody needs data literacy, because data is everywhere. It’s the new currency, it's the language of the business. We need to be able to speak that.”—Data science expert, Piyanka Jain

Yes, we know meticulously assessing data isn't always fun, but mortgage analytics are often pivotal for effective lead generation. They offer insights into market trends, borrower behaviors, and potential growth areas. By analyzing data like loan performance, default rates, and borrower demographics, lenders can pinpoint promising expansion areas and target marketing efforts more precisely.

Advanced data tools can reveal patterns in successful loan applications, aiding credit decision processes and product customization to meet specific customer needs. This use of mortgage analytics helps lenders capture high-quality leads and proactively adapt to market shifts, keeping them ahead in a competitive industry.

Shape integrates analytics into its all-in-one mortgage platform, enhancing lead generation and management. This integration provides lenders access to vital mortgage data, streamlining the process of identifying and targeting potential leads. Shape's CRM includes features like ShapeIQ for lead scoring and Shape AI for leveraging artificial intelligence.

What's more, its platform offers Realtor & Partner Referrals and a co-branded borrower portal, maximizing the ROI of closed loans through effective partner and referral management. This comprehensive approach allows lenders to make data-driven decisions, aligning with industry dynamics and customer expectations.

14. Invest in an SEO-optimized blog

Today, content truly is king, and this applies as much to mortgage industry as any other.

According to DemandMetric, companies with blogs produce an average of 67% more leads monthly than those that don't blog. This statistic highlights the effectiveness of blogging as a tool for increasing visibility and establishing authority in your industry, thus attracting more potential clients

A blog can be a powerful and cost-effective tool for generating free mortgage leads by offering valuable content that attracts potential clients. By consistently posting informative and engaging articles related to the mortgage industry, a blog can establish the author or the company as a knowledgeable authority in the field. Topics could range from tips on securing a favorable mortgage to insights into current market trends.

“It’s not about trying to crank everything you can into the article. It’s about delivering value and persuading people you can solve their problem in as few words as possible.” – Tim Soulo, CMO of Ahrefs

This approach not only boosts visibility through search engine optimization (SEO), making it easier for potential leads to find the blog when searching for mortgage-related information, but it also helps build trust with the audience. As readers find helpful advice and answers to their questions, they are more likely to consider the services of the blog's host when they need a mortgage, transforming readers into potential leads.

The main takeaway for generating free mortgage leads? Simple – Invest in technology!

That wraps up our ultimate guide to generating free mortgage leads. While some businesses may prefer to pay for leads, in our experience, we've seen that free and low-cost leads are more sustainable and have a significantly higher upside.

In the last twenty years, the mortgage world has experienced a remarkable shift thanks to the integration of technology. Gone are the days of lengthy, paper-heavy mortgage processes, replaced by streamlined, efficient systems thanks to Loan Origination Systems (LOS) and the internet. These advancements have made applying and getting approval for loans faster and more user-friendly, leading to significant time and cost savings for both all relevant parties.

It's also resulted in the transformation of lead generation strategies. On your quest for top-tier free mortgage leads, utilizing technology effectively will be essential if you want your mortgage business will be able to compete.

This is where Shape CRM can help. It's user-friendly, cost-effective suite of tools are specifically tailored for today's tech-driven mortgage world. With features like web traffic conversion, email automation, integrated phone dialers, and AI-powered solutions, Shape CRM is optimizing the mortgage process, making it faster, more efficient, and more responsive to borrower preferences.

Whatever method you choose, we wish you luck on your lead generation journey!

Need more business advice? Take your pick from one of our many well-researched articles

©2022 Shape Software

Publishing Rights: You may republish this article in your web site, newsletter, or ebook, on the condition that you agree to leave the article, author’s signature, and all links completely intact.