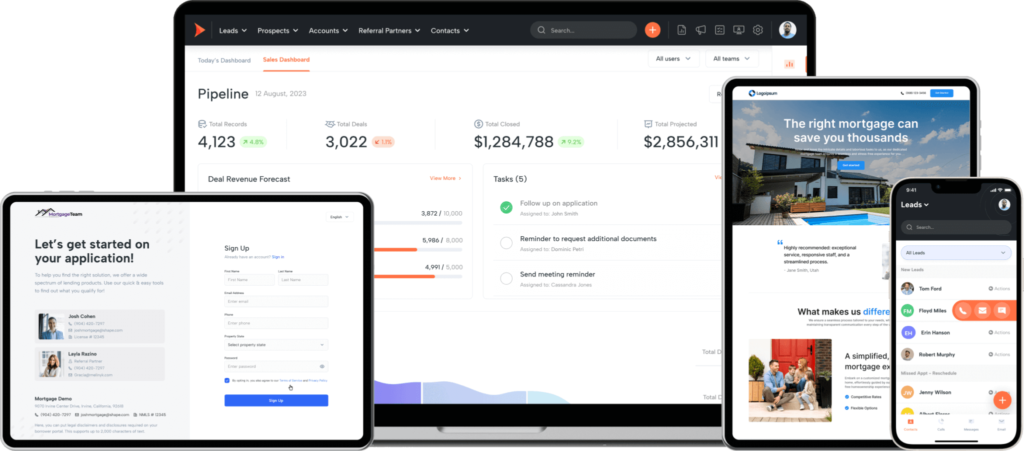

Get started with Shape today!

All-in-one software for marketing, sales, customer service, CRM, and operations.

Share article

Mortgage Lead Generation: Strategies, Tools, and Insights for Loan Officers and Lenders

-

Chloe Larson

Today, a relatively new business can surpass other older and more established companies if they successfully achieve one goal: generating leads. This is especially true of the mortgage industry, which is becoming increasingly crowded and buyer behavior is constantly shifting. This means the ability to effectively generate new mortgage leads has become the defining factor in whether a company succeeds or not. Successful lead generation enables MLOs to identify and engage with prospective clients, fostering valuable connections that drive business growth. This is why it's invaluable not only to know how to market to realtors, but also cultivate a successful pipeline that converts qualified leads into valued clients.

The objective of this guide is to provide you with the necessary knowledge for mortgage lead generation techniques. By looking into strategies backed with social proof, you will obtain the knowledge and skills to bring in new clients. These strategies can be leveraged and tailored to fit any business model. If you're a seasoned loan officer or a lender looking to optimize your approach, this guide will be your roadmap to success in today's competitive marketplace.

What is mortgage lead generation?

This refers to the process used by lenders or brokers to identify and attract potential borrowers. It involves marketing and outreach efforts, such as advertising, digital marketing, and partnerships, aimed at capturing the interest of individuals or businesses seeking a mortgage, ultimately to convert them into clients.

Table of Contents

- 1. Key strategies for effective mortgage lead generation

- 2. Understanding the sales funnel in the mortgage landscape

- 3. How are trends and technologies reshaping mortgage lead generation?

- 4. Innovative tips for generating mortgage leads

- 5. How can online techniques enhance mortgage lead generation?

- 6. Essential software tools for mortgage lead generation

- 7. Understanding different types of leads

- 8. Targeting specific mortgage lead types for better conversion

- 9. What lead generation strategies should loan officers employ?

- 10. Effective MLO lead generation techniques

- 11. Securing high-converting mortgage leads

- 12. How can the quality of leads be improved?

- 13. Best practices for buying mortgage leads

- 14. Marketing strategies for mortgage leads

- 15. Managing your mortgage lead pipeline

- 16. How Shape CRM can take your lead generation to the next level

Key strategies for effective mortgage lead generation

The success of any company – big, small, old, or new – hinges on setting up a comprehensive approach. This involves everything from networking with real estate agents, to purchasing leads and landing pages that utilize loan officer Search Engine Optimization (SEO). Establishing connections with real estate agents who are talking with your target market every day is a great way to build insights that are easy to overlook with only online tools.

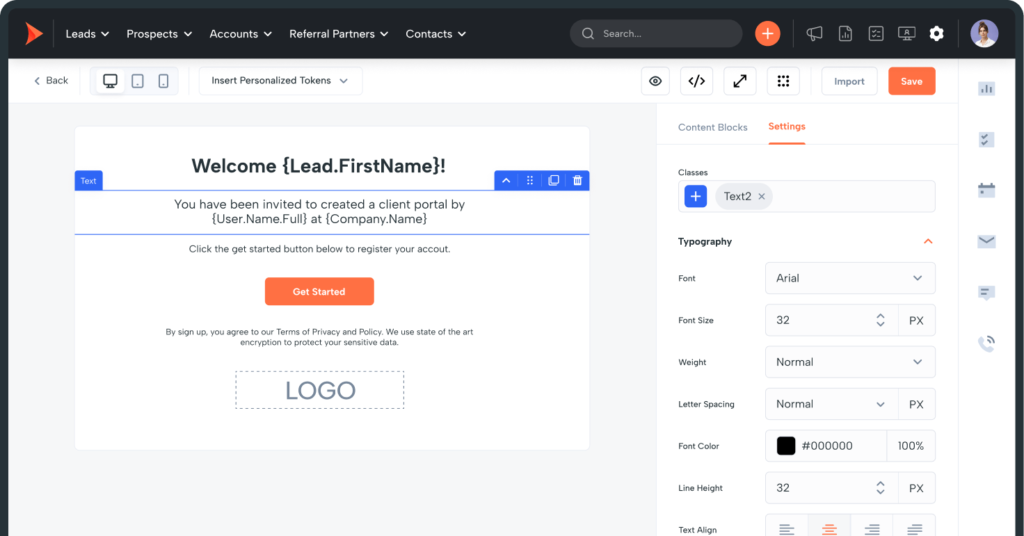

That’s not to say online tools aren’t helpful, they’re just as necessary. Shape’s SEO toolkit ensures people see your business when they do a Google search for you or the services you provide. You can also purchase a landing page through Shape, which is a webpage designed to organically bring in clients, even when you don’t think about the page. These strategies will help position your business to conquer the marketing battlefront from both fronts.

Understanding the sales funnel in the mortgage landscape

Recognizing the journey potential borrowers undertake from initial awareness to the final decision of choosing a lender or broker. At the top of the funnel, awareness is key. This stage is where prospective clients first learn about your mortgage services, often through marketing efforts such as digital advertising, content marketing, or local SEO. These strategies are designed to cast a wide net, reaching a large audience and informing them about the mortgage options available. The goal here is to capture the interest of those in the early stages of considering a mortgage, whether for a new purchase, refinancing, or other related needs.

As potential clients move down the funnel, the focus shifts to engagement and consideration. Here, tailored communication through email marketing or personalized follow-ups plays a crucial role. Prospects start evaluating their options, comparing different lenders, and delving deeper into the specifics of what each service offers. Effective communication in this stage involves educating the prospect, addressing their specific needs and concerns, and positioning your service as the optimal solution. The bottom of the funnel is where conversion happens – turning leads into actual clients. At this stage, trust and credibility have been established, and the prospect is ready to make a decision. Here, the effectiveness of the entire funnel is tested, as it's the point where a lead decides whether to proceed with your service or not.

How are trends and technologies reshaping mortgage lead generation?

The evolution of lead generation happens quickly, so you should always be on the lookout for trends and cutting-edge technologies. Do what works for your business, but be sure to integrate new strategies and marketing tools into your business to stay innovative. AI has allowed businesses to automate lead sorting, and streamline traditional marketing strategies to boost efficiency.

The rise in mobile apps has made banking more accessible and convenient, while also enabling companies to gather more banking data than ever before. With this venture into big data, mortgage loan companies can better target potential clients based on their needs and preferences, and turbocharge their digital advertising based on those targeted preferences.

Innovative tips for generating mortgage leads

Be sure to think outside the box and use innovative strategies to supercharge your mortgage lead generation efforts. Host educational webinars to position yourself as an industry authority, captivating potential clients. Enhance engagement with interactive financial calculators, offering personalized insights. Amplify your reach through targeted ad campaigns on digital platforms, ensuring your message resonates with the right audience. These tips, meticulously crafted, inject creativity into lead generation, transforming it into a dynamic process that not only attracts but also nurtures valuable connections in the competitive mortgage landscape.

How can online techniques enhance mortgage lead generation?

The game-changing potential of online techniques can elevate your mortgage lead generation to a new height. Use SEO tactics crafted for local searches, making sure your business shines in your community. Dive into content marketing through blogging—share your expertise, and build trust with potential clients. Boost your visibility with pay-per-click (PPC) advertising on Google Ads, strategically putting your business in front of people actively looking for borrower solutions. These online strategies are the solid foundation for a contemporary and effective lead generation approach in the ever-changing world of the sector.

Essential software tools for mortgage lead generation

Now, let's explore essential software designed to streamline and enhance your mortgage lead generation strategies. Shape is a comprehensive tool that offers assistance with Clickthrough Rate Management (CRM). Every time a client clicks on your marketing email, for example, that gets turned into valuable data that can be used to discover what works and what could be improved. There are also the SMS lead generation features, which send out text messages to draw in new clients. Overall, the tools in Shape offer a comprehensive strategy, and allow users to customize how they want to generate leads.

Understanding different types of leads

The broad spectrum of leads can be overwhelming for a new mortgage loan officer. However, they also offer a diverse array of opportunities for professionals in the industry. Getting to grips with this variety is key to understanding the unique circumstances of different clients, whether they are first-time homebuyers, those seeking refinancing, or exploring new mortgage options. Each type of lead comes with its own set of challenges, making it crucial for mortgage professionals to tailor their strategies accordingly. Let’s take a closer look at the different kinds of leads within the mortgage sector:

1. Mortgage broker

Specifically targeted for brokers, which may include both home purchase and refinance opportunities.

2. Mortgage refinance

These are specifically interested in refinancing their existing mortgages. They can be particularly valuable as they often have a clear intent and urgency.

3. Home loan

Prospective clients looking for new mortgages for home purchases. These are crucial for lenders and brokers focusing on new home buyers.

4. Exclusive

These are sold exclusively to a single buyer or lender, ensuring that the recipient has sole access to that particular lead without competition from others. They are often the most beneficial, but also the most expensive.

5. Non-exclusive

As opposed to the above, these are sold or shared with multiple MLOs or lenders. While they are less expensive, they require more effort to stand out in the competition to convert the lead.

6. Real-time

Also known as live or hot leads, these are delivered to mortgage professionals immediately after generation, allowing for prompt follow-up. They are actively seeking information, demanding readiness for immediate engagement.

7. Aged

These were initially generated as exclusive, non-exclusive, or real-time but were not purchased within a certain time frame. They are the least expensive but come with the risk that the lead might have already chosen their loan officer.

8. Telemarketing generated

Created through a team of telemarketers calling potential customers about a mortgage loan. There are variations, such as a live transfer of the potential client or transferring caller information after contact.

9. Direct mail generated

These are generated through mailings sent to targeted potential clients - considered generated if the clients respond via phone or internet.

10. Broadcast-generated

Generated through radio or television ads, collectively known as 'broadcast' leads. Despite the emergence of new media, traditional broadcast media can still be effective in generating leads.

11. Affiliate partner-generated

These are generated by companies specializing in other types of leads but can generate mortgage leads based on their existing traffic.

12. Online-generated

Arguably the fastest-growing type, these are generated through various online channels such as paid advertising, search engine marketing, SEO, online video advertising, websites, and social media.

13. Semi-exclusive

These are a variation of exclusive leads sold to 2-3 different companies, resulting in more competition than exclusive leads but less than non-exclusive ones.

14. Trigger

These are created when someone's credit report is accessed for a mortgage inquiry. Lenders and brokers get these from credit bureaus, indicating that the person is actively seeking a mortgage. While they show high intent, they also come with privacy considerations.

15. Live transfer

These involve potential borrowers who are on a call and transferred directly to a mortgage professional. They are valuable because they are pre-qualified and ready to discuss mortgage options, offering high conversion potential.

Phew! We know that seems like a lot to take in. However, many of the above overlap, and while some require specific lead generation strategies, a comprehensive strategy will cover many of them.

Targeting specific lead types for better conversion

To make the most out of your leads, you need targeted strategies. Create personalized landing pages tailored to each lead type, making potential clients feel understood. Utilize segmented email marketing campaigns to speak directly to the needs and interests of different leads. By tailoring our approach, we increase the chances of converting these leads into satisfied clients on their homebuying journey.

What lead generation strategies should loan officers employ?

One solid way of developing leads is an old-fashioned strategy, but a proven one – getting involved with your community. Attending events and connecting with the community. Next, build professional relationships, especially online through social media marketing and personal branding. Make sure your online presence is top-notch for better search results and leverage mortgage CRM platforms to manage contact information efficiently. By weaving in social media, local engagement, and online marketing, loan officers can build quality leads and open new avenues for business growth.

Effective MLO lead generation techniques

There are several techniques that any Mortgage Loan Officer (MLO) can use to connect with potential leads looking for home loans. The first is to offer referral programs. Get others to recommend your services for a fraction of the cost of a typical lead conversion, it’s a win-win. Another technique is to develop partnerships with industry professionals, such as real estate brokers, to get a fuller picture of the market. This comes with the bonus of referring one another to clients.

Here's our gen of a tip for any MLO looking to gain quality leads – create an educational blog. You are an expert in your field, and people are going to have loan questions that they will search online. Having an educational blog will direct those people with questions to your website for answers, where they can start to be funneled into high quality leads.

Securing high-converting mortgage leads

We can make sure the folks interested in mortgages become happy clients by focusing on specific groups who really need what you offer – that's what it means to target niche markets. Improve your website to make it easy for visitors to find what they’re looking for. This improves the customer experience while making sure you capture the attention of your niche market. Don’t stop there, use a scoring system to figure out which leads are most likely to become clients. You need to track what lead channels work best so you can put your money into lead generating strategies with the best returns.

How can the quality of leads be improved?

We should also make sure the leads you get are top-notch. The market’s always shifting, and the best way to keep your strategies fresh is by regularly updating your list of potential clients. Use segmentation to divide your leads into groups based on how much they're interested in your product or service. This will help you tailor your approach to maximize effectiveness. And NEVER forget to ask for feedback – it's free advice to make your strategy more effective, and you lose nothing by asking. With these strategies, you not only find potential clients, but also make sure they're the best fit for what you offer in the world of mortgages.

Best practices for buying mortgage leads

Next, let's talk about the smart way to get in touch with potential clients by buying mortgage leads. You’d be shocked by how many mortgage lead generators sell low-quality leads. In some cases, they will even sell leads who have already bought a mortgage. This is why, first and foremost, check if the source where you're getting leads from is trustworthy. Then think about how much each lead costs and pay attention to how engaged these leads are with your services. High engagement means you’re getting high-quality leads, like getting fresh produce at the supermarket. These tactics ensure you invest wisely in leads that can turn into happy clients.

Marketing strategies for mortgage leads

Alright, let's talk about some strategies for generating free and low-cost leads, and how you can spread the word to help folks find your mortgage company.

- Targeted Digital Marketing – It's strategies like using Google Ads to show up right when someone's looking for a mortgage. It’s like putting a billboard for a restaurant right in front of someone who mentions they’re hungry.

- Content marketing – Imagine creating blog posts and videos that answer all the questions people might have about mortgages. They naturally get drawn to you looking for answers, see you as an authority, and become more likely to trust you for your services.

- Email Marketing – If you're only email-led strategy is just to have your company email address on your website, you're doing it wrong! Email marketing is an incredibly powerful tool in the mortgage industry, allowing you to send out newsletters and drip campaigns, thereby increasing the likelihood of conversions. In enables you to keep in regular touch, and provide value to prospects, so they think of you when they’re ready to get a mortgage.

- Local SEO – Today, a mortgage broker who wants to remain competitive must have an locally SEO-optimized website as a foundation to build upon. After all, having an online presence enables you to rank higher in local search results. This makes it easier for people in your area to find you when they're searching for mortgage services nearby.

By following these techniques, you're not just promoting mortgages; you're making sure people know you're the one to trust on their home-buying journey.

Managing your mortgage lead pipeline

Handling leads can be a hassle, which is why there are tools and strategies ready to help keep them sorted. First up, there are these handy tools called CRMs. They're like personal assistants but for managing your leads. CRM tools (like those provided by Shape) keep everything organized and on track.

Then, there's lead nurturing. It's like taking care of a little plant, but instead of water, you're providing regular follow-ups and useful information to keep potential clients interested. It’s a way to make leads grow into a conversion. Lastly, there are conversion tracking methods. Imagine having a map to see which paths are working best in finding clients, you can close roads that have little traffic and expand the roads that have too much traffic. By using these techniques, you not only manage your leads but also make sure you're always aware and in-control of your marketing campaigns.

How Shape CRM can take your lead generation to the next level

To recap, key strategies like networking with real estate agents and leveraging online tools like Shape's SEO kit have the power to help your business thrive in the competitive landscape.

From networking with real estate agents to leveraging online tools like Shape's cutting edge lead engine, we've explored comprehensive approaches. The rapid evolution of trends and technologies, including AI and mobile apps, are no longer optional for staying ahead - it’s mandatory. Understanding different lead types and tailoring approaches for professionals and MLOs ensures a well-rounded guide for your success.

Now armed with knowledge, seize the opportunity to implement these strategies in your mortgage business. Whether you're a seasoned professional or a newcomer, cultivating connections with real estate agents, harnessing online tools, and staying abreast of evolving trends is crucial.

Embrace innovation and use these online techniques to elevate your lead generation. Tailor your approach for different lead types, engage with your community, and utilize social media for effective MLO lead generation. Remember, success in mortgage lead generation is not just about finding leads, but nurturing valuable connections in the dynamic mortgage landscape. Your journey to success starts with a simple action – be engaged, be informed, and be proactive.

If you have any other questions or are looking for more personalized insights, don't hesitate to reach out to us today.. We’d also love to hear how these strategies have helped you with your business, or if there’s anything you’d like to add. And if you'd like to see for yourself why Shape is the number one CRM in US for mortgage professionals, request a demo today.

The Best Mortgage CRM - Shape

4.8/5 - from 2,000+ reviews

All-in-one software for marketing, sales, customer service, CRM, and operations. Improve communication and maximize your business.