Get started with Shape today!

All-in-one software for marketing, sales, customer service, CRM, and operations.

Share article

Learn How to Market to Realtors as a Loan Officer & Boost Referrals

-

Shape Software

Are you a loan officer struggling to drive referrals? Do your current marketing strategies yield poor results? Unsure how to ask a realtor for business? Shape is here to help! In this comprehensive blog post, we'll show you how to market to realtors as a loan officer, and make your mortgage business attractive to real estate agents. Implement the strategies below, and you''ll be at the forefront of realtor's minds when it's time to refer clients.

First and foremost, the mortgage industry built on relationships. Therefore, to elevate your marketing game and attract more referrals, it's crucial to understand the best ways to engage real estate agents. If your goal is to foster a dynamic relationship with a real estate business and create a consistent influx of referrals, this article is your go-to resource. From leveraging the latest marketing tools to mastering referral etiquette, we cover it all.

And that's not all. We've enlisted insights from Stacey Brown Randall, a leading authority on referral strategies. In her first year, Stacey generated an impressive 112 referrals, and now she empowers businesses to replicate her success.

Right, let's explore how to market to realtors as a loan officer and become the go-to choice for realtors in your area!

Table of contents

- 1. 5 challenges facing mortgage loan officers

- 2. 8 effective marketing ideas for loan officers

- 3. How do I introduce myself to a real estate agent?

- 4. How do I get mortgage referrals from realtors?

- 5. Utilize private Facebook groups

- 6. Teach continuous education classes

- 7. Define your perfect referral

- 8. Host custom events for realtors

- 9. Identify your top referral sources

- 10. Building referrals as a team

What are the 5 Challenges facing mortgage loan officers in 2024?

Considering almost 30% of business is conducted online, and technologies like AI are rising exponentially, it's clear that "change" is the theme of our times. While this change comes with numerous opportunities for loan officers, it also presents challenges. So before we delve into know hot to market to realtors as loan officer, you need to be aware of the some of challenges:

-

1. Outdated networking tactics

The traditional methods of networking, like casual lunches and exchanging business cards, aren't as effective in securing referrals from real estate agents. Today’s market demands more strategic and value-driven relationships.

-

2. Intense competition

The mortgage industry is highly competitive, with many loan officers vying for the attention of real estate agents. This fierce competition means that agents are often overwhelmed with generic pitches, making it harder for loan officers to stand out and grab their interest.

-

3. Evolving market demands

The real estate landscape is constantly changing, and experts predict technology well play an increasingly vital role. This means loan officers must stay updated and adaptable. Agents now prefer working with those who aren't only knowledgeable but also innovative in their approach.

-

4. Need for trust and reliability

As we mentioned, building strong relationships has always been crucial in this industry Agents seek out for loan officers who are reliable and have a proven track record, so establishing a reputation for consistency and integrity is key to gaining and maintaining referrals.

-

5. Excellence in service

Providing outstanding service to both the agent and their clients is essential. Agents are more likely to refer loan officers who contribute positively to the client experience and ensure smooth, efficient transactions.

8 effective marketing ideas for loan officers marketing to realtors

In today's mortgage industry, both national mortgage lenders and independent loan officers must utilize savvy mortgage marketing strategies to stay ahead. While many of these strategies are transferable across all businesses, they must be tailored to the unique demands of the mortgage industry, as well as your target realtors. So if you want to know how to market to realtors as a loan officer, the tips below will serve as a useful starting point:

As is the case in any industry, understanding your target audience is key to effective marketing. Carefully consider the perspective of realtors.As loan officers, it's essential to realize that real estate agents are looking for partners who can add value to their client interactions. Up to 21% of mortgage referrals come from real estate agents, but tapping into this source requires more than just casual networking. It demands a strategic approach that resonates with the agents' needs and expectations.

- 1. Get your digital marketing game going!

Today, marketing and digital marketing are often used interchangeably – and no wonder! The internet is usually a non-negotiable core of marketing strategies. Unsurprisingly, topping out list of how to market to realtors as a loan officer is the endless potential of online marketing. And we completely understand: this subject encompasses such a wide spectrum of tools and strategies that it can feel overwhelming. However, beyond hiring experts, even learning the basics of Search Engine Optimization (SEO), content marketing, and social media marketing can work wonders for your mortgage business.

An effective SEO strategy will help to improve your visibility in search engine results, making it easier for realtors to find you when they search for mortgage-related information. Make sure you keep your Google Business Profile updated, as this not only boosts your local SEO and online reputation, but provides essentials like your contact information and client reviews.

- 2. Engage through social media

When it comes to mortgage broker marketing, regular, informative posts on social media platforms can keep your audience engaged. Share insights about the mortgage process, tips for home buyers, or updates on your services. This consistent presence helps you stay fresh in the mind of not only client, but realtors too.

- 3. Create virtual events for lead generation

Organize virtual events for realtors to demystify various aspects of the mortgage process. These online gatherings are pivotal for loan officers, offering an engaging platform to showcase expertise, build trust, and foster relationships. Participants often provide contact details during registration, creating a valuable pool of potential leads. Such events not only educate realtors but also position you as a go-to resource, enhancing your network and referral opportunities

- 4. Develop a strong email list

Across all industries, email marketing is an essential part of the digital toolkit, maintaining engagement, securing leads, and boosting brand awareness. It enables loan officers and mortgage brokers to share valuable content with potential mortgage leads, like advice on improving credit scores or navigating the loan process, which goes a long way in building trust.

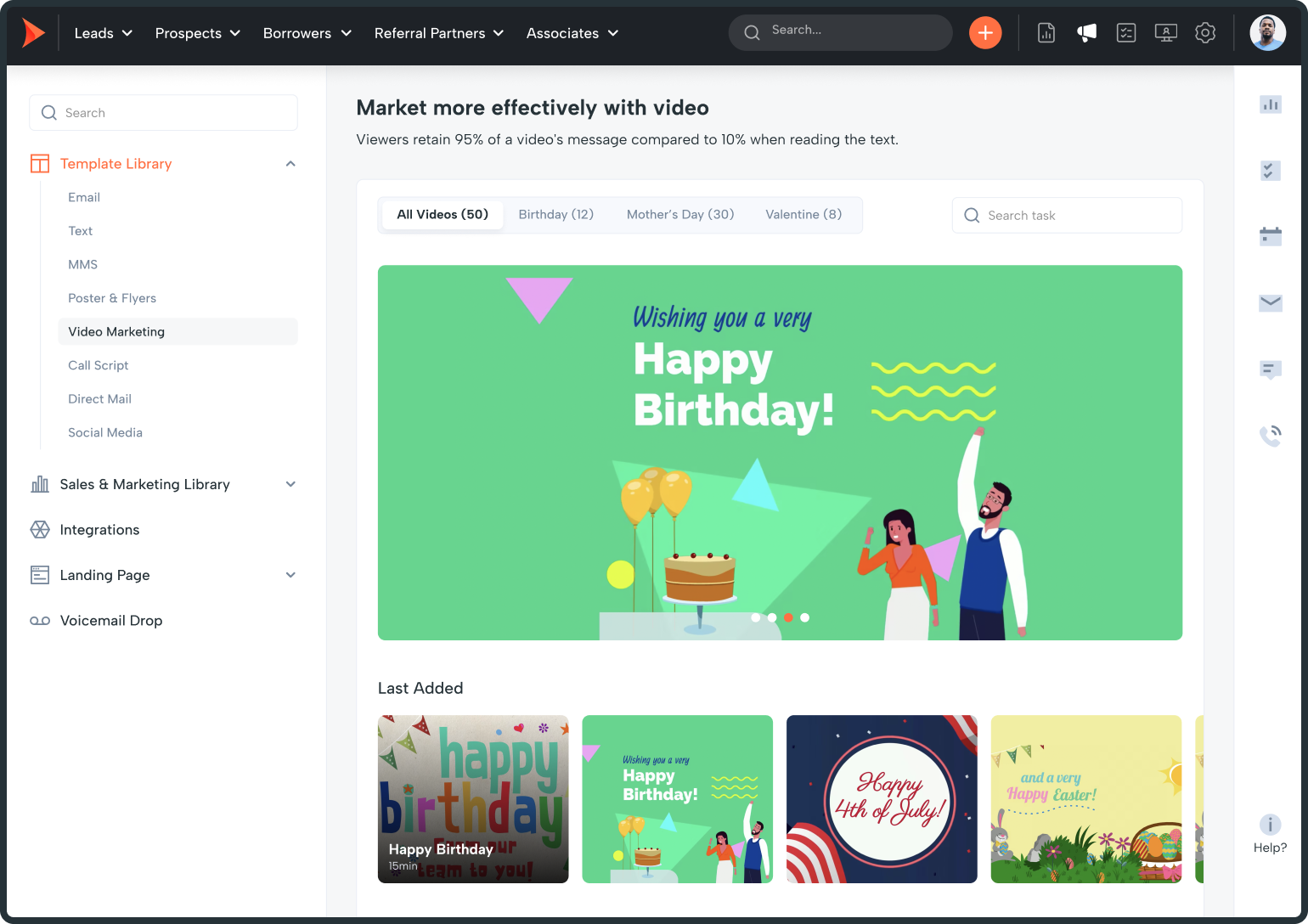

- 5. Utilize video marketing

When it comes to how to market to realtors as a loan officer, never underestimate the power of video! 86% of digital marketers currently use video, and 82% of global traffic came from streaming and downloads in 2022, so it's clear this medium shouldn't be overlooked. Given its popularity and SEO value, YouTube remains the best avenue for video marketing. Given the high retention of this type of media, using it to offer mortgage industry insights and best practices is highly effective.

A mortgage loan officer marketing to realtors can share information tailored to their needs, such as market trends and professional tips, loan officers can establish themselves as knowledgeable resources in their field. This approach not only aids in building trust and credibility among realtors but also helps in generating quality leads. Regular updates with relevant content keep the audience engaged and reinforce the loan officer's reputation as a reliable figure in the mortgage industry

- 6. Personalize your approach

The last thing prospective realtors want to see is a "one-size-fits" all attempt to pique their interest. Showing you understand the specific needs of your clients (or client-base) goes a long way, not only selling you to estate agents but enabling you to tailor your approach accordingly. Whether you're a loan office or mortgage broker, satisfying the specific needs of discerning realtors is crucial.

- 7. Encourage client reviews

Marketing statistics show social proof to be an incredibly powerful marketing asset Request reviews from satisfied clients. Positive feedback, especially on your Google Business Profile, improves local SEO, significantly enhances your credibility, and makes you a more attractive proposition for realtors.

- 8. Coordinate marketing efforts across platforms

In marketing, integration is everything, so you should ensure your marketing efforts are coordinated across various channels. Whether it's your Google Business Profile, social media posts, or your YouTube channel, ensure your messaging is consistent and targeted. Not only will this improve your local SEO and overall authority, but will present a compelling picture to realtors.

Mastering Multi-Channel Communication with Real Estate Partners

Building strong relationships with real estate agents requires a strategic approach across multiple channels. A successful loan officer marketing strategy combines personal connection with systematic follow up processes. Here's how to maximize your outreach:

Digital Communication Excellence

Start with a well-crafted loan officer introduction email to realtor template that you can personalize for each contact. Develop a suite of real estate email templates for different scenarios, from sharing additional information about financing options to coordinating co-hosting events. These personalized emails help streamline your process while maintaining an authentic touch.

Event-Based Networking

Consider hosting events tailored to different segments of your network. From educational seminars about the home buying process to casual open houses, these gatherings provide natural opportunities for personal visits and relationship building. Working with established relationships to co-brand these events can be cost efficient while helping you reach a new audience.

Content and Marketing Collaboration

Create marketing materials that benefit both parties. This could include:

- Co-branded listing flyers for specific properties

- Shared social media posts about market updates

- Joint email marketing campaigns targeting potential buyers

- Educational content about the financing process

Make your real estate agent relationships stronger by offering to help make their job easier. Whether it’s providing quick pre-approvals for interested buyers or sharing relevant examples of successful deals, focus on creating a win-win situation that encourages ongoing collaboration.

Regular Follow Up and Engagement

Maintain connection through:

- Weekly personal visits to partner offices

- Monthly market update emails

- Quarterly co-hosted events

- Regular social media engagement with their own posts

By implementing these strategies systematically, you’ll create a robust network of real estate agent relationships that consistently generate potential clients.

How do I introduce myself to a real estate agent?

Next up in our loan officer tips is the subject of introductions. Some naturally excel at this while others may find it more challenging. While much of how to market to realtors as a loan officer will be online, this is still a person-focused industry. So, when introducing yourself to a real estate agent in person, begin with a firm handshake, a professional attitude, and a clear introduction. State your name, your role as a loan officer, and the company you represent. This approach immediately establishes your professional credentials and sets the tone for the interaction.

Next, succinctly explain the benefits of your expertise for both the agent and their clients. Highlight specific aspects of your service, like unique loan products, efficient processing times, or specialized services that you provide. These details demonstrate how your involvement can streamline transactions and support the agent's work. Conclude by expressing your interest in building a mutually beneficial relationship, emphasizing the potential for successful collaborations that benefit all involved parties.

Now we've covered how to market to realtors as a loan officer, lets dive into the our in-depth look at how to build a referral network that pays off.

How do I get mortgage referrals from realtors?

It's important to note, that while there's obvious overlap with marketing and generating referrals from realtors, the latter is much more industry-specific and should be handled accordingly. So, to begin, let's cover the fundamentals of the process.

- Ensure its sustainable

Getting an avalanche of referrals one week and then getting almost nothing for months is not something you want for your mortgage business. You want your stream of referrals to be steady and reliable no matter where the market is.

- It must be business-appropriate

Not every referral will work for your company, and not every real estate agent will be a great referral partner. This article will show you how to gain referrals that are the best fit for your mortgage business.

- Prioritize scalability

Essentially, if you want your mortgage business to grow, you need to make sure your referral network can grow with it. The tips below will help you identify opportunities for referral growth and create a referral plan for the whole company.

So, without further ado, here are seven insider tips on how to build a sustainable and scalable referral network of real estate agents. Follow these, and realtors will love consistently sending new business your way.

Tip #1: Generate loan referrals from realtors without asking

"When a loan officer applies the ‘prospecting hustle’ mentality to their referral efforts, it’s a recipe for disaster."

Stacey Brown Randall with Stacey Brown Randall Coaching

Stacey Brown Randall is a best selling author, a national speaker, and a coach-founder at Stacey Brown Randall Coaching

Stacey is a mortgage marketing genius. She’s helped dozens of businesses and hundreds of professionals build referral generating plans and triple their number of referrals within mere months. She calls it the “referral explosion.”

The jaw-dropping twist?

Stacey attracted these referrals without even asking.

Loan officers are constantly prospecting for new clients. But when you apply the same approach to generating referrals and start chasing down Realtors for more business, the results are often underwhelming.

“The ‘hustle for business, always be prospecting and closing’ mentality is stronger than ever which puts us in a particular frame of mind when it comes to lead gen and sales,” Stacey explains.

Instead, Stacey advocates for building lasting relationships with your referral partners.

‘‘My philosophy and methodology shifts the way you think of referrals,” Stacey adds, “It gives you a roadmap to follow where you focus on the referral source (or partner) relationships for long-term success.”

Here are just a few tips that will allow you to build deep, lasting relationships with agents and get a steady stream of referrals without even having to ask:

- Research agents

Before you initiate a convo with any real estate agent, try finding some information about them. What are they good at? What do they like? What do you have in common? How can you help them?

- Drop the sales perspective

Realtors are not your end clients, and you’re not making a close. You are building a relationship—agents send referrals your way when they like you. Strive to find things in common—don’t talk business all the time.

- Make it about them

Every agent knows why you’re calling. You’re not the first loan officer to take them out for lunch. Your only objective during the first meeting should be to learn how to help this particular agent. Don’t make your ask too soon.

- Plant referral seeds

Never directly ask about referrals, but send soft signals that you’re open to them. For example, instead of asking “How many referrals can you give me?” you can share how many referrals you’re getting and how you’re helping those clients.

As Stacey shares, the relationship-based approach can have a profound effect on your entire company. “The more you spend time focused on building and maintaining relationships, your whole perspective changes on how you want to run your business,” she says.

You can learn more about generating referrals without asking, plus get specific workflows to engage real estate agents and plant referral seeds from Stacey’s book Generating Business Referrals Without Asking: A Simple Five Step Plan to a Referral Explosion or through her referral generating coaching program.

Tip #2: Utilize private Facebook groups

Many loan officers use Facebook pages and groups to market their brand. In recent years, more LOs and brokers have opted to make their pages or groups private to boost engagement and trust by making the information you share feel exclusive and community-oriented.

Here are some tips to turn a private Facebook group into a referral generating machine:

- Provide unique information

Your posts should be both highly relevant to agents’ business goals and unique. Create content that is hyper-focused on your location or niche, or join real estate groups to learn about the industry’s hottest topics.

- Follow a regular posting schedule

No one likes dead-weight Facebook groups. Make sure to stay on top of agents’ minds by regularly popping up on their Facebook feed with new updates and posts. The best way to do this is to develop a content plan and stick to it. Tools like Buffer, Hootsuite, and MeetEdgar are also great options for automating your social media updates.

- Show some personality

Your goal is not to sell agents yourself. The goal is to do business with agents that like you. So don’t be afraid to record videos, take stances on something important to you, and be yourself! It’s all about building up that know-like-trust factor.

- Engage with everyone in your group

Make a point of replying to all comments in your group. This allows you to develop deeper, more meaningful relationships with friends and group members.

Tip #3: Teach continuous education classes

Education is one of the best ways to provide value to Realtors upfront, while demonstrating your loan expertise to agents in an organic and non-intrusive way. And you don’t have to look too far for success stories.

Just a few weeks back, we interviewed Brian Sacks, a nationally renowned mortgage expert and speaker who also happened to close 38 loans in just one month after getting referrals by teaching seminars and webinars to real estate agents and helping them understand the current market trends.

But if you want to take it to the next level and have a steady stream of agent referrals, why not let the system help you? Become an NMLS-accredited continuous education (CE) provider.

By teaching CE classes you get regular access to an audience of engaged real estate agents who need to learn in order to keep their licenses. No one will supply you with referrals simply because you teach CE classes. Make sure your courses are engaging and full of valuable knowledge, and never use them as a selling platform.

- Change your program periodically

If you keep teaching agents the same thing over and over, they won’t regularly get back to you and you won’t have a chance to build a lasting relationship. So add a twist to your classes from time to time. You can:

- Invite new presenters

- Change the format

- Hold a Q&A session

- Or simply add new information

- Work on your branding and marketing

Treat CE classes as a strategic business investment, rather than an obligation. Track your attendance rates and conversion. Make sure to follow up with your attendees to nurture the relationship and maximize your conversion rates. You may also want to take some time to work on your branding in order to stand out from a myriad of other CE providers. Establish an online presence, work on your logo and slogan, and convince agents why they should attend your classes and not someone else’s with a strong marketing message.

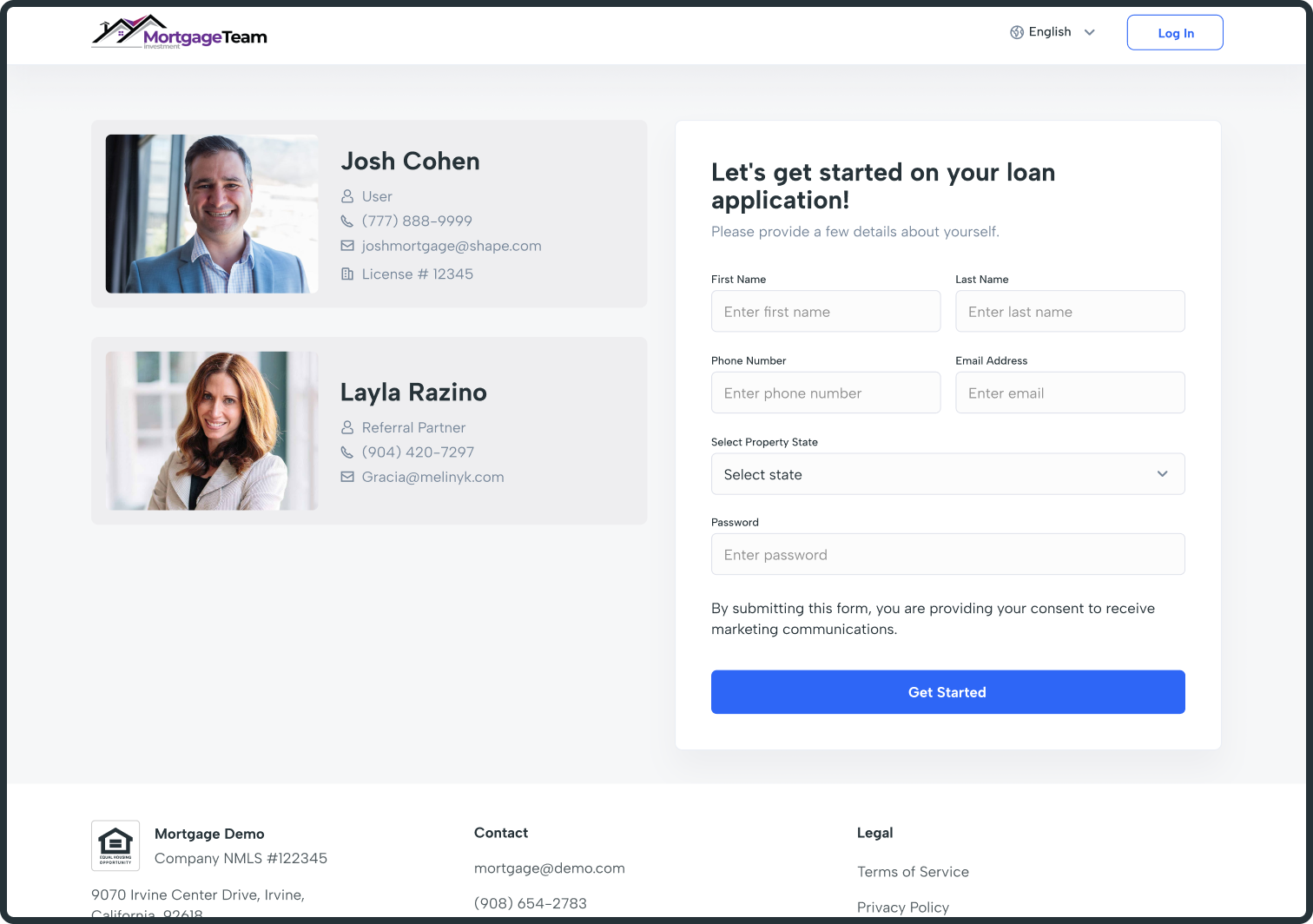

- Leverage technology to boost attendance rates

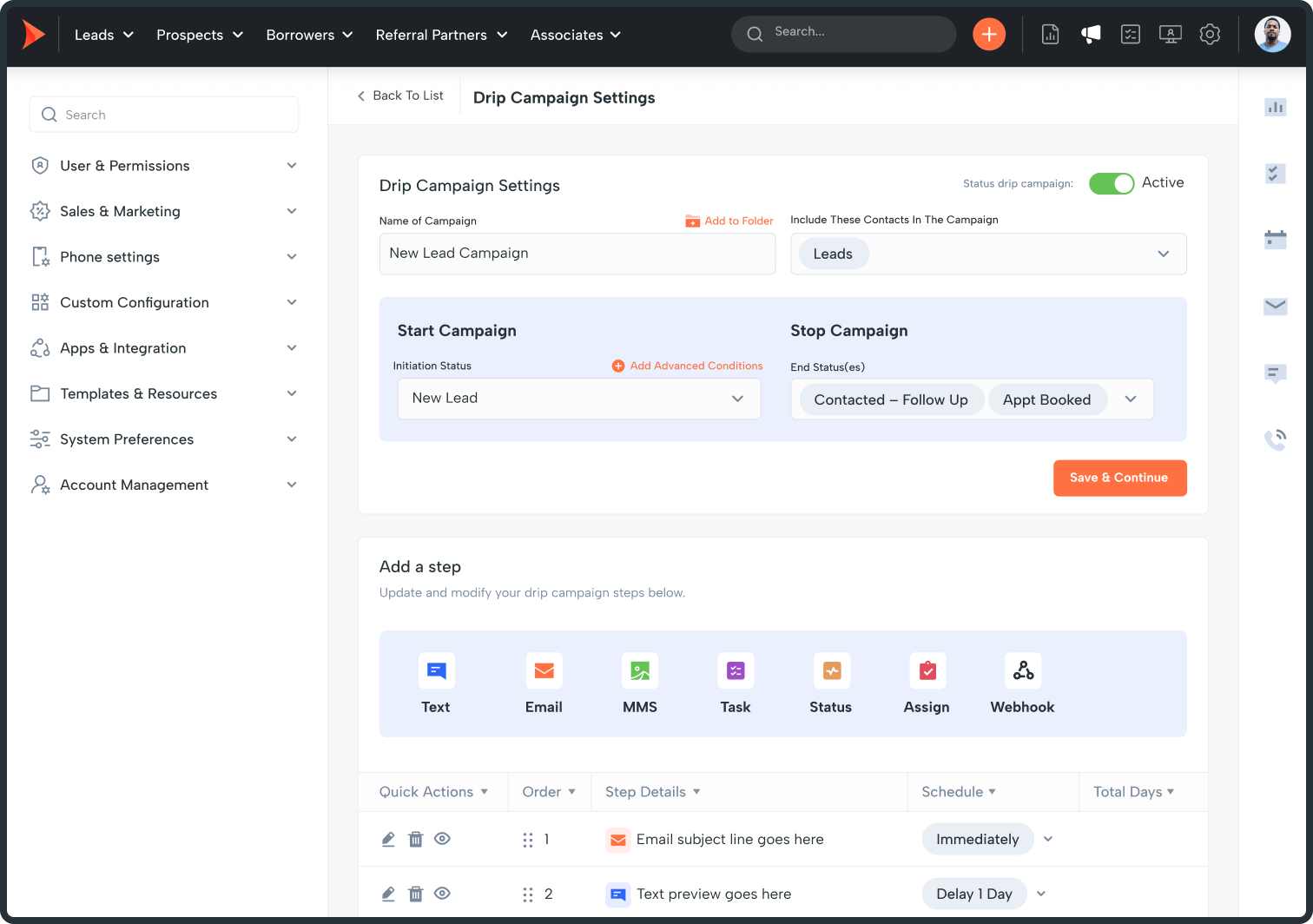

Almost all loan officers utilize a CRM to work with their leads, so why not use the same approach to boost your referrals? The right mortgage CRM will help you automatically follow up with your participants and keep in touch with them after the course ends. But above anything else, a CRM can help you boost attendance rates. NMLS-accredited CE providers have access to a local database of Realtors, including their emails. Simply import the contact details into your CRM and schedule a drip-campaign to go out anyone who is interested in your courses. From there, all you have to do is keep the conversation going!

Tip #4: Define your perfect referral

Sometimes you get referrals that simply don’t work—they take too much of your time, or they’re not ready to do business just yet. For whatever reason, they don’t feel like a referral at all.

You might call them “bad” referrals, but the thing is there is no such thing as bad referrals. But there are poorly defined referrals.

Let’s boil it down to the essentials. There are two defining characteristics of a referral:

- A referral is a client directly introduced to you

Either through a shared email or conversation. In this scenario, a real estate agent introduces you to a potential client directly. A non-direct introduction, such as giving out your business card, is not a referral. It’s more like a warm lead.

- A referred client has a specific problem that you can solve

Ideally you should be presented as a solution to someone’s problem. If a prospect has no specific problem that you can help with, again, it’s more of a warm lead for your business—not a pure referral.

When you have a clear vision of what your ideal referral looks like, you can inform your partners of the best ways to refer you to others.

Take time to crystalize the definition of a “referral” as it pertains to your particular mortgage business. Who are your ideal clients? What’s the service that you’re best at? Identifying your ideal client will help you communicate to your agents and other referral partners the type of clients you’re after, and why you’re the best option to help them.

This approach benefits you, the agent, and the customer—which results in even more referrals.

Tip #5: Host custom events for realtors

When it comes to building relationships with real estate agents, many loan officers think only of a 20-minute lunch, a handwritten postcard and then a series of never ending emails.

Of course, every now and then a great opportunity comes through the traditional way—like a shared community event or local masterclass. But why wait for an upcoming community event when you can host it yourself?

Knock your competition out of the park with custom events created exclusively for your real estate partners. Done right, you won’t have to spend much money on these events. In fact, some of them will cost you nothing but your time.

Here’s how to earn extra points with agents through custom events:

- Provide unique value

If everyone is writing about the ‘3 hidden challenges of underwriting a loan’, how about spicing things up by inviting an underwriter for an interview and then live streaming the event in your Facebook group?

- Make events memorable

The best way for agents to remember you is to create something they’ll never forget, and a face-to-face client appreciation dinner is much more memorable than a handwritten note or a generic email newsletter.

- Engage your agents

Whether it’s a webinar, a party, or a masterclass, make a point of engaging with your guests and audience. Reply to comments, spark conversations, and always look for ways you can help agents with their current struggles.

Tip #6: Identify your top referral sources

Not all your partnerships with agents will be equally beneficial to your mortgage business: inevitably some agents will refer more clients your way than others.

Identifying your top referral sources is important for two main reasons:

- 1. Real estate partnerships don’t last forever

Real estate agents engage with many loan originators and are constantly being poached by new ones. That’s why you should never rely solely on existing partnerships. Consistently work with your top referrers to develop new ways to benefit their businesses in order to keep the partnerships fresh and mutually beneficial over a longer period of time.

- 2. Scale partnerships that work

After you identify your best referrers, you can understand what kind of agents you’d like to build relationships with going forward and how to build new relationships that are just as strong. Additionally, learning what works for you and your team allows you to save time and resources on building relationships that you don’t want.

Tip #7: Building referrals as a team

"People refer people, not companies"

Stacey Brown Randall with Stacey Brown Randall Coaching

Stacey Brown Randall is a best selling author, a national speaker, and a coach-founder at Stacey Brown Randall Coaching

Referrals are a great way to grow your business and build up a clientele, but can you use referrals as a business strategy for your whole company?

Stacey’s reply is a resounding “Yes”—but with a twist:

“You should have a company ‘referral plan’ but it should be created to support your individual loan officers and their referral generation efforts.”

Simply put, each loan officer on your team needs their own referral plan and referral source relationships. “The company plan starts with educating them on how to generate referrals without asking,” Stacey explains, “then having them create their own referral plan to follow.”

Here are a few tips on building a sustainable referral network for your whole company:

- Support your loan officers with resources and accountability. Share your connections, use your CRM system to help your LOs identify their best sources of referrals, and follow up by setting clear accountability workflows and referral targets.

- Get your team members in front of Realtors. Don’t be a bottleneck for your company. If someone on your team is great with certain tasks, don’t hesitate to introduce them to your partners to demonstrate their value.

- Market your team to real estate teams. Indicate that as a mortgage team you provide complex services with many people working together to help every client. This is something real estate teams can directly relate to, and thus feel more comfortable sending clients your way.

Agent referrals can be a powerful source of clients for your mortgage company, but don’t leave this stream of business to a chance. Make a conscious effort to build lasting relationships with agents by providing excellent service, giving value up front and planting referral seeds along the way.

That wraps it up!

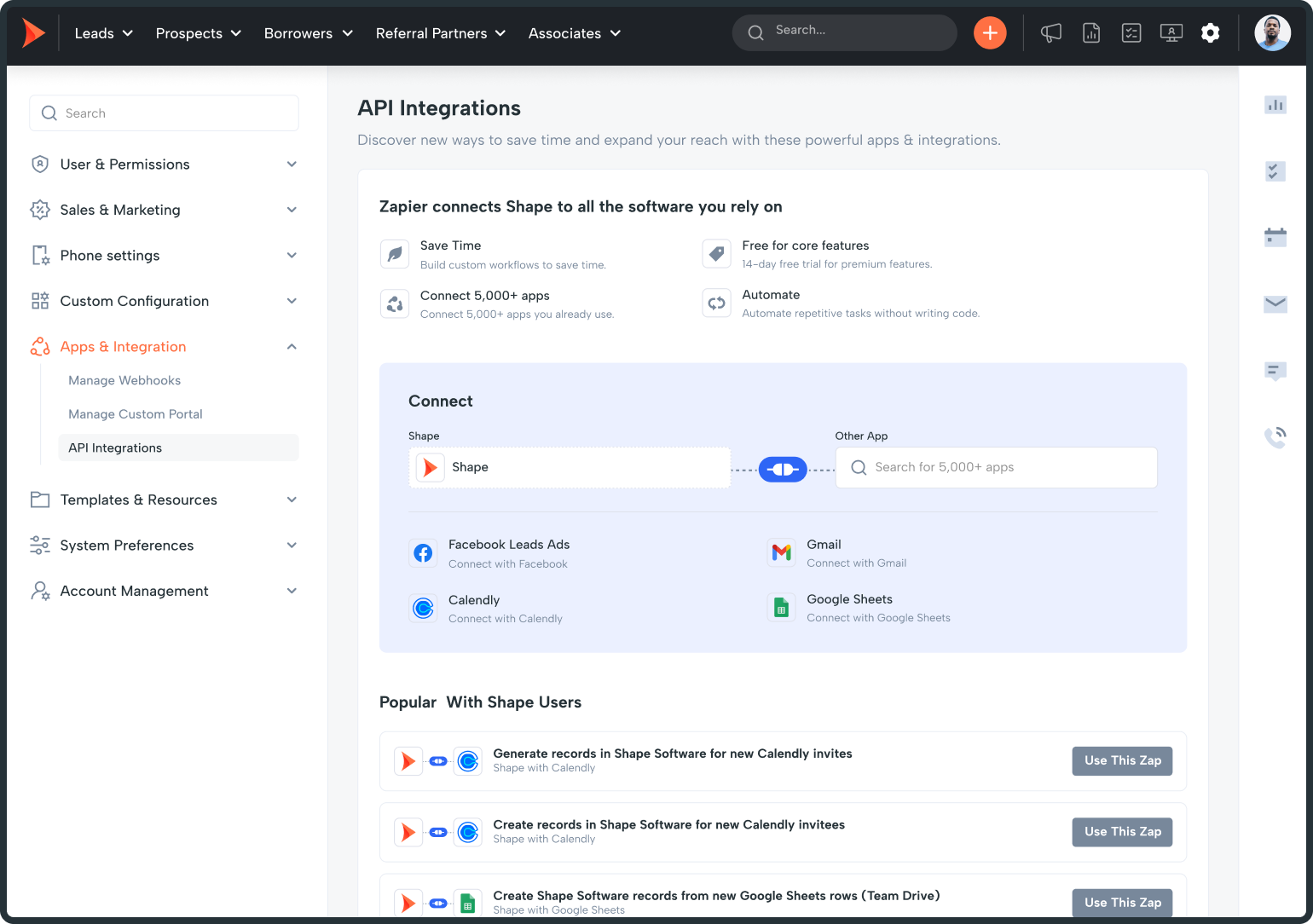

If you want to see how an easy-to-use mortgage CRM can help you attract referrals in a systematic and consistent way, try Shape.

Through smart automation and lead distribution, Shape reduces the amount of time loan officers spend on routine tasks and allows them to spend their time on what’s really important: helping clients and building relationships.