Increasing Revenue

Closing more loans with an improved cost per acquisition.

Reducing Wasted Time

Improve your sales and fulfillment processes though marketing automation and seamless APIs.

Reducing Expenses

Collapsing your tech stack by combining multiple software features into one system, such as, point of sale, dialer, texting, marketing, etc.

Remarketing Lead Generation

Generating purchase, refinance, and referral leads for you and your team.

To save you time of demos with various mortgage software solutions, we’ve compiled a list of the most important considerations when selecting the best mortgage CRM for you.

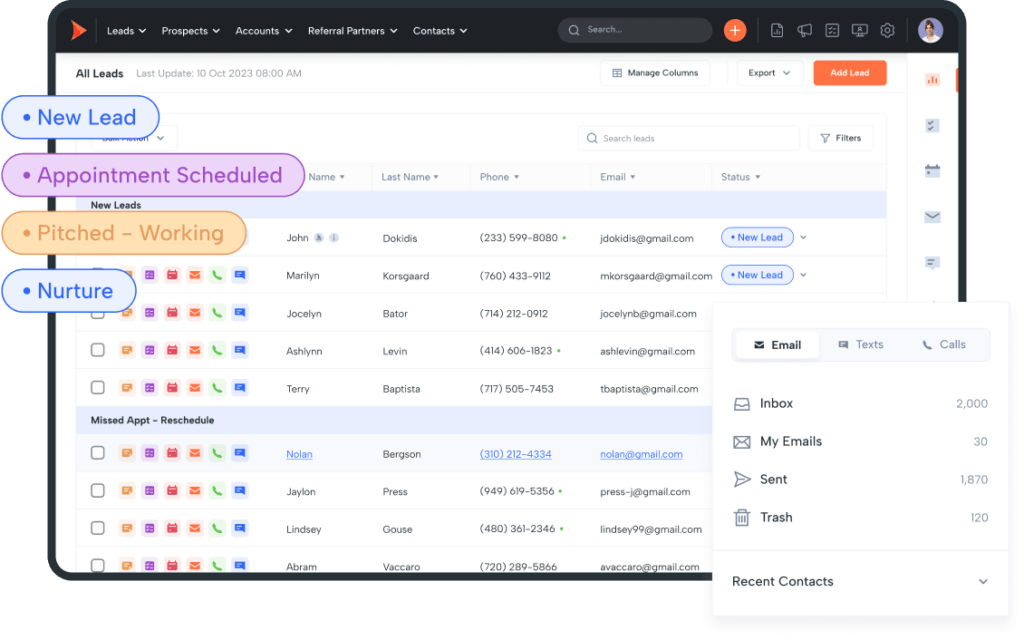

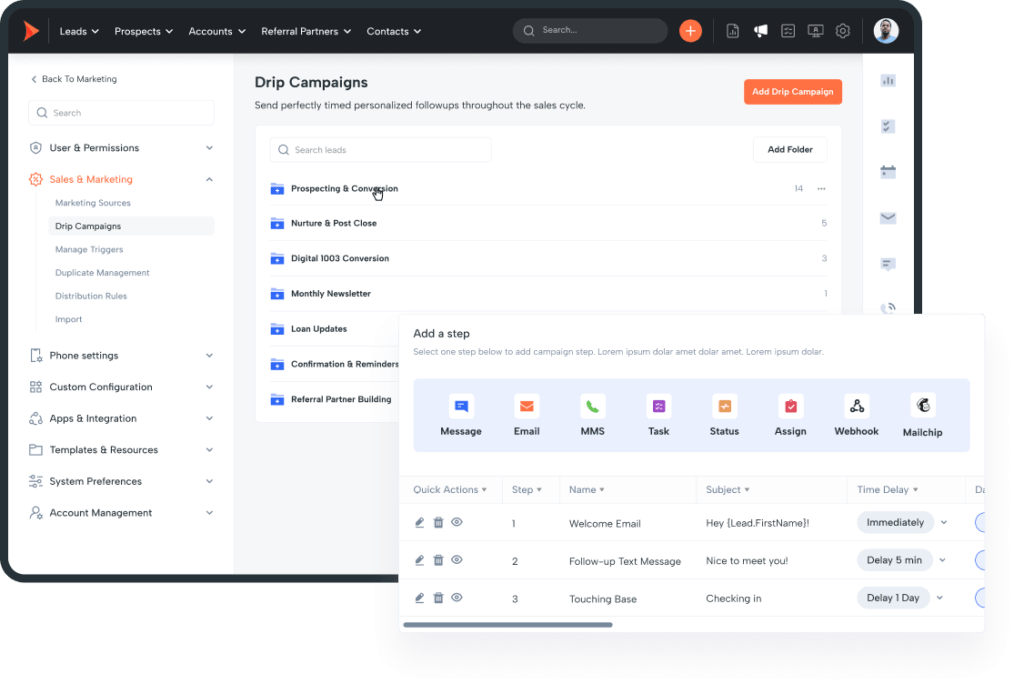

Mortgage lead volume is one of the most important determining factors of a successful mortgage business. If your CRM can generate leads for mortgage brokers, you will have a successful mortgage operation. Your mortgage CRM should be integrated with all your lead providers (paid leads, referrals, google, live transfers, etc.) but it should also double as your mortgage lead generation software. Limiting the number of software platforms and logins you have to use and maximizing the ease of use to be able to generate leads and close loans using a single platform is very important. Some of the best mortgage lead generation companies use Shape to generate leads for mortgage brokers with the following lead generation features:

Integrations with companies like Lendingtree, Free Rate update, leadPops, Bank Rate, Zillow, and more.

Automatically attract borrower purchase finance and refinance leads with pre-set email campaigns, to your existing and potential clients.

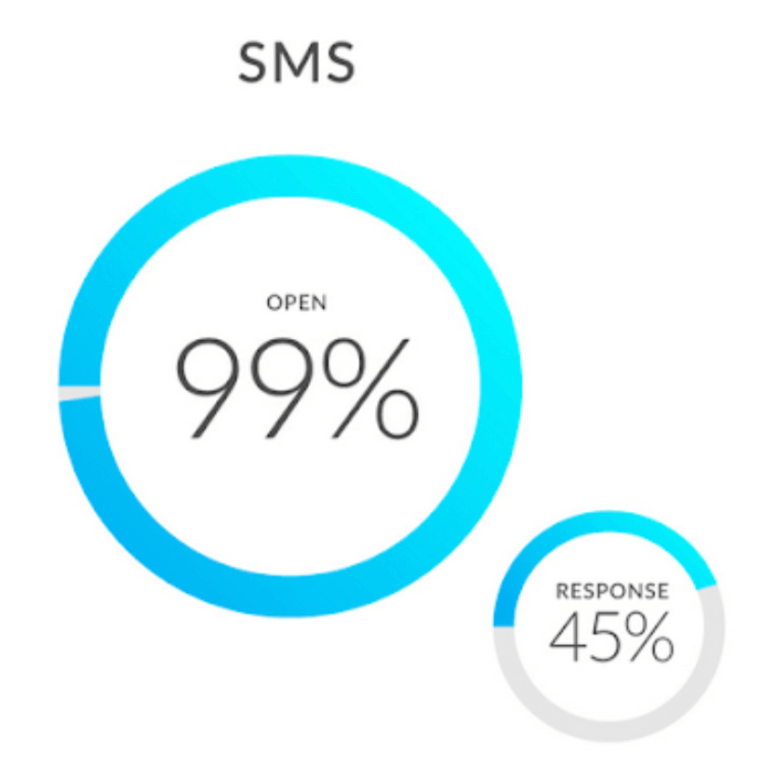

Bulk text campaigns based on triggers, or timing, to increase the view rate on your messages to 98%+.

Multi-year automated email, text, and remarketing campaigns to bring back clients year after year.

Inbound call routing, email triggers, etc.

Post URL and other website integrations to improve lead-to-close automation.

Specific mortgage content and software automation to bring in mortgage leads.

Online banner advertising directly to your contacts in your CRM.

Nurturing and pulling-thru incomplete POS applications via email, text, and phone.

Co-branded marketing with realtors and partners, as well as nurturing and recruiting referral partners through marketing automation.

Facebook, Google, Linkedin etc.

Sales & marketing automation.

Digital application & document collection.

Mismo 3.4 and other automatic-syncing.

Enterprise phone without integration.

Individual, bulk, and trigger based.

Pre-made marketing content.

Maximizes your revenue per minute.

Increase user productivity by 240 hours per year.

Access to 4,000+ applications.

Ownership of your data is vital.

Monthly contracts and the ability to add/decrease users as needed.

Phone, email, and self-serve support.

Webinars, marketing strategies, etc.

Reviews and awards.

Custom reports and pre-built business reports.

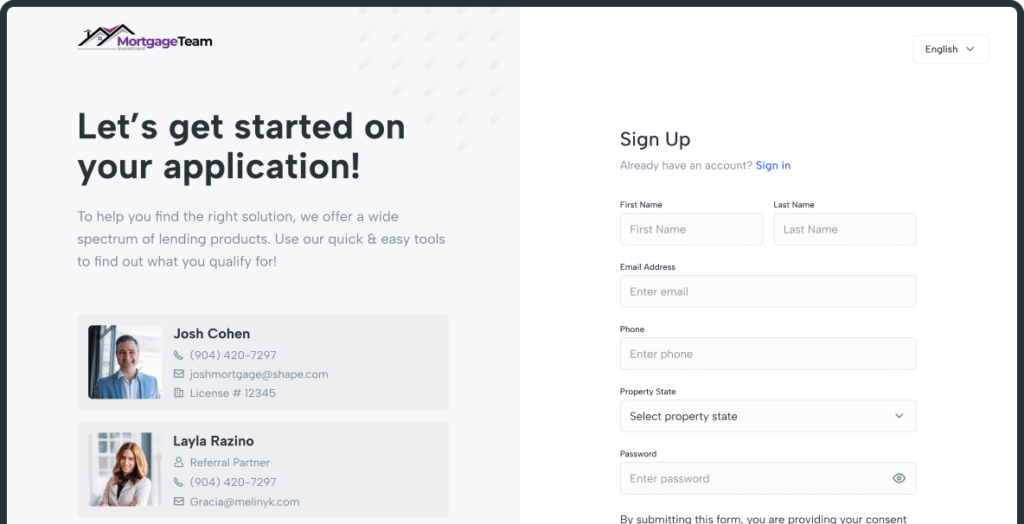

A mortgage POS or “borrower portal” as some call it, is typically a borrower or client facing online website where a 1003 application can be completed by a borrower. “Native” mortgage point of sale software means it comes with your CRM for mortgage, without having to integrate or purchase third party software. Shape’s native mortgage POS offers all the benefits you want without having to worry about buying or integrating any third-party software:

Here is our quick list of the must-have features for your mortgage POS:

This can be a game-changer if your POS (and CRM). One of the largest time-sucks for loan officers and processors is the manual entry and conversion of pictures or JPEGs into a PDF.

The conversion rate of completed applications increases significantly when a LO or mortgage broker has the ability to access a borrower's computer (with their consent) to assist with uploading documents, bank statements, or other forms, etc. If you've been in the industry long enough, you probably have some terrifying stories about trying to assist clients when you can't see what they're seeing. When your 82-year-old customer phones and complains that they can't download the bank statement you requested because they're not tech smart, you can not only view their screen but also take control of their cursor and do it for them; they love you for it, and everyone gets their day back!

Your POS should be native (built-into or come with) your CRM and not separate software that needs to be integrated with your CRM. There are hundreds of features and integrations that could potentially be lost if your CRM and POS are not built into one. Email automation, text automation, status and progress triggers can help save you time and generate more loan volume when the two solutions (CRM and POS) are offered in a single software.

Your logo and information, displayed directly on your POS and website. Working with realtors? Co-brand with them to provide a trust-building landing page for customers to apply.

The ability to generate emails based on triggers and statuses from your borrowers is key. Most borrowers will not complete an application on their first attempt, so having the automation to pull them back through the process is important.

Credit checks and verifications directly within the POS is important so that you can identify which borrowers have the highest likelihood of closing.

Uploading documents (tax returns, driver’s license, etc.) securely via an online portal is necessary to streamline the closing process.

Many of your borrowers will need a portal that is in Spanish, Mandarin, or another language so that they can understand and complete the application process.

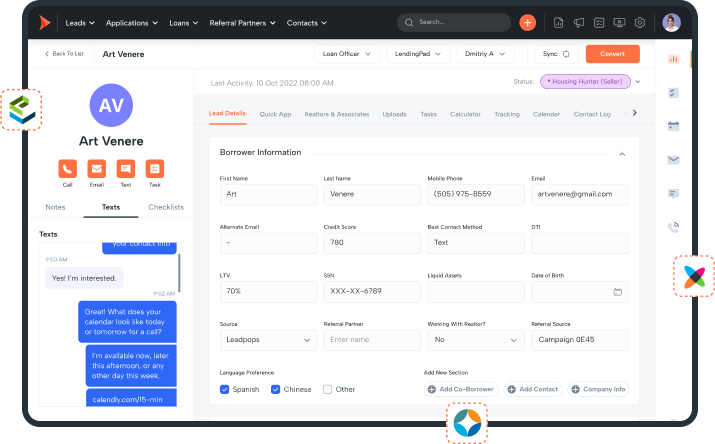

A CRM that integrates with your LOS can save hours of manual data entry. The best loan officer CRM should have a seamless direct integration with your loan origination System (“LOS”). Mortgage LOS systems take a completed loan application or 1003 form, ideally directly from your Mortgage CRM System, and they help close the mortgage by providing the following:

Loan Pricing / Pricing Engine

Loan Eligibility

Loan Underwriting

Document Management

Compliance

Not all LOS integrations are the same, and it’s imperative that your mortgage crm has a Direct Bi-directional Non-export LOS Integrations (“DBN LOS Integrations”). DBN LOS Integrations mean there is no need to export and/or import files between your CRM and LOS and the information between the two automatically sync, without you having to manually update anything.

Shape Mortgage CRM has native integrations or generates 3.4 files that map directly to all the top loan origination systems including:

LendingPad

Encompass

Calyx

Byte Software

LendingDox

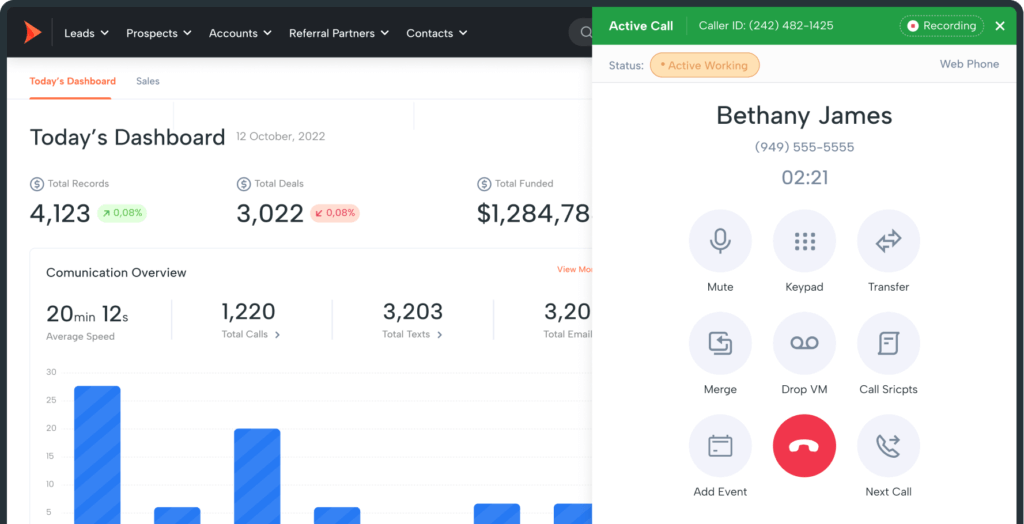

This is a big one. A CRM without a native enterprise phone is almost just a glorified filing cabinet. Almost 100% of your closed loans will have some sort of phone interaction, and it’s still the best way of closing deals. A native enterprise phone system is important for the following reasons:

Increase speed to lead by using a fully automated webphone that routes calls and allows power dialing with a click.

Without a native phone system you’ll typically be charged an extra one time or monthly fee just to use a phone with your CRM

Any time you need to integrate your CRM with another software there is a risk that they won’t work properly together so making sure your dialer comes with your CRM is important.

A phone integration with your CRM (instead of a native phone system) typically only has partial integration functionality. For example, calls may not be stored within your CRM, or statuses within your CRM may not be tied to calls etc. With a native phone system, 100% of the phone is integrated with your CRM.

Don’t be fooled by mortgage CRMs that claim they have a phone system or dialer and then charge to integrate with other phone systems like PhoneBurner or RingCentral. Or worse, a phone system that doesn’t have full IVR, call routing, autodialer / click to dial, etc. functionality.

The best mortgage CRM dialer should have as many of these features as possible:

Track all calls and call metrics.

Save time by clicking a button to leave a voicemail so you can move quickly to the next call.

Automate your sales and marketing with your dialer using call dispositions.

Use local area codes automatically when calling to increase your phone conversions and pick-ups.

Ring all, round robin, assigned team members, etc.

Prioritize calls to remove guesswork and wasted time.

Record all inbound and outbound calls.

See live call activity or listen to live calls.

Some CRMs will also charge $20-$70 per month just to turn on phone functionality, in addition to your usage (per minute) costs. It’s important to select a Mortgage CRM that comes with an enterprise phone system built-in so you don’t have to buy or integrate with a phone system like Ringcentral, Ytel, or Five9.

Email and text automation within your CRM is possibly the most important feature of any sales and marketing automation software. The robustness of the automation is second. For example, a 1-minute response time can lead to a 400% increase in conversions whereas 2 minutes later drops conversions by over half, and every minute thereafter is a massive drop off.

For every $1 spent on email marketing, the average ROI is $44

Customers are 2.1x more likely to view personalized and timed messaging as important

73% of Customers prefer to use email when communicating with companies

Nurture

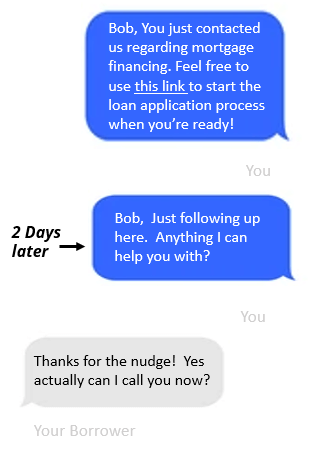

Did you know over 70% of your leads are not ready to move forward the first time they reach out? Using email automation to nurture these leads until they’re ready to move forward will save you wasted time reaching out to prospects not ready, and will also make each conversation you have ideally with prospects with a higher probability of closing.

Follow Up

Have you made any of these promises before, but then got busy or forgot to follow through:

“Great I’ll follow up with you in a couple days”

“Sure, I’ll send you the docs later today”

“You want me to call you next week when you’re back from vacation? Sure no prob”

With proper email automation, you don’t need to remember to follow up since it will get done no matter how busy you get.

Post-close Automation

After you close a loan, you should do four things with your clients:

With proper email automation and templates, like Shape has pre-loaded with every system, this is as easy as clicking a single button.

Text Automation can be used for most of the same email automation strategies but texts offer a few distinct advantages:

Gathering Borrower Documentation

Getting in front of your borrowers to complete loan documents or other items is much easier through texts.

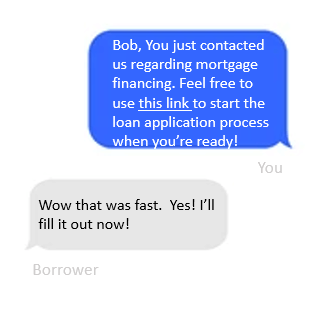

Speed to Contact

Sending an automatic text to your clients right when they fill out a form or schedule a time to meet. Ideally they are sent to your mortgage portal link to start filling out an application.

Follow-up Automation

Automatically time and send follow-ups so you don’t have to remember to, and let your software do all the work.

As a mortgage broker it’s hard enough generating lead volume, convincing borrowers to fill out application information, and closing loans – the last thing you need is to have to come up with content and designs for your marketing materials.

Having a CRM like Shape, with pre-built (and free!) marketing content can save you months of building and testing content. Here is some of the pre-built marketing content available with every Shape mortgage system:

Thousands of Email / Text Templates – Pre-built email and text templates including nurture, follow-up, and post close templates.

Social Media Marketing/Posting

Display Advertising

Video Marketing

Content Exchange

Direct Mail Marketing Postcards

Text Templates

MMS (Multimedia Texts)

Lead scoring automatically identifies the highest revenue opportunities for you to contact first, instead of wasting time aimlessly contacting leads and prospects in your CRM. If your CRM doesn’t offer it, you’re basically just guessing what you should be doing each time you log in. Instead of just blindly responding to emails, calling back leads, and dialing a list, with lead scoring you can use machine learning and artificial intelligence to tell you which of your hundreds of leads you should call first, to generate more revenue.

Managing your time successfully with so many different activities can be challenging. Without a proper procedure in place, this can result in low conversion rates, and sales funnel dropouts.

Knowing when to contact a lead can help salespeople stay on track, focus on the right leads, and be more productive. Empower your sales staff to work more efficiently.

Lead scoring can instantly analyze hundreds of factors in an instant including:

Automatically prioritizes and de-prioritizes leads in states that you’re licensed and not licensed in respectively.

Higher credit scores should be weighted heavier than lower credit scores given the closing probabilities.

Your fee on a higher balance loan may be higher than a lower balance loan so prioritization for higher revenue opportunities is taken into consideration.

Years of employment, age, and a variety of other demographic information play a large part in the probability of a loan closing.

These are just a few of the hundreds of different factors that a proper lead-scoring solution will automatically calculate for you. With lead scoring, you’re able to spend time on leads that generate revenue, not just on leads.

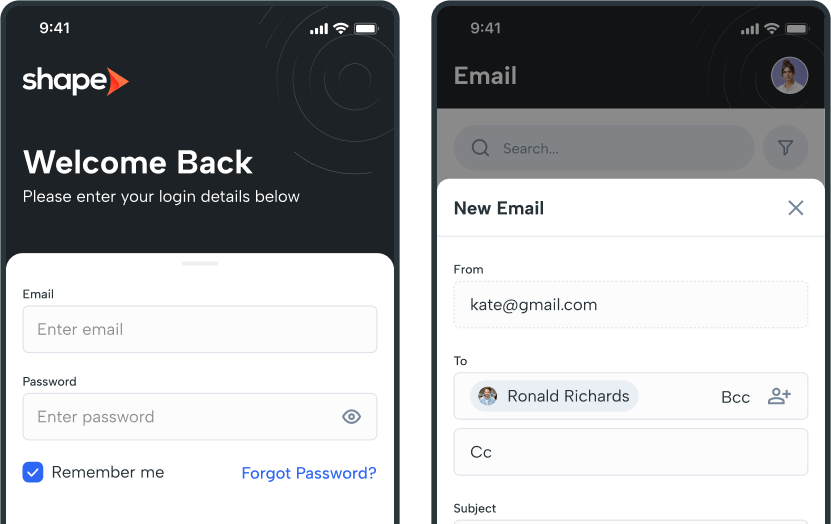

A CRM mobile app allows you to get an average of 240 more hours of work per year from each employee. At the average loan officer’s salary that’s an additional $22,988 of work from each employee.

Employee Productivity – Pre-built email and text templates including nurture, follow-up, and post close templates.A CRM mobile app allows you to capture more time and productivity from each team member but it also positions your company to be ready as employee preferences and the ease-of-use to manage tasks on mobile devices shift toward mobile vs. desktop usage. For companies looking to recruit and hire the best talent, having a mobile app available for this talent is a requirement.

Client Service – A mobile CRM app can help ensure that your clients and customers are getting the best service available at all times. With a mobile app your team members are fully equipped to provide clients with the reliable information they need, at speed.

Faster Lead-to-close Timelines – Accessing information, accounts, calling/texting/email, uploading and sharing documents, etc. and the ability to work on the go means faster deal closings and more revenue for your company.

Employee Satisfaction – Your team’s ability to have access to real-time updates and vital information, accounts, and the ability to work on the go is not only a “nice-to-have” it is a must-have. Employees want the flexibility to be able to work when they want, including nights and weekends, in a user-friendly way. Your team no longer needs or wants, to sit at their desks all day to work. Employees work at different offices and locations and are often on the road and they need access to schedules, accounts, and documents when they’re not in the office.

A mobile CRM app has many benefits for remote workers when they’re away from their desks enabling them to:

Plan using calendar integration

Dial into meetings with click-to-call

Access and update leads, contacts and opportunities

Open and share files

Access dashboards on the go

Track, manage, and respond to customer service cases

Access to up-to-date data at all times

CRM integrations allow you to customize and develop the most ideal CRM software for your business. No CRM on the planet can do everything, so it’s important to identify the integrations your CRM has, and also the types of integrations.

Here are some of the topics you should investigate when considering a CRM’s specific integrations:

Zapier – A CRM that integrates with Zapier allows your CRM to gain access to over 4,000+ integrations. Many CRMs do not have an integration with Zapier and if they do, they only have a few “Zaps” set up and only with specific fields. Make sure to understand which Zaps your CRM has already set up.

Bi-directional Integration – A bi-directional integration means the integration goes both from and to the integrated software. For example, you may have an integration with an email provider (like Gmail or Outlook), and a bi-directional integration allows you to send and receive emails from your CRM with that integration.

Fields – Not all integrations are created the same. Two CRMs can both say they have an “integration” with software, let’s say it’s a LOS like LendingPad for example, but the integrations can be wildly different. The different fields (in both your CRM and the integrated software) that are connected can vary by tens or hundreds.

Selecting a CRM that integrates with all the various software solutions you use can automate hundreds of hours of automation.

Many mortgage brokerages and businesses are branches or parent companies that provide and own the software provided to you. When this occurs, they technically own the software, and most importantly the data, in the system. This means that if you were ever to change companies or offices, oftentimes you’ll lose all the data (leads, prospects, contacts etc.) and you’ll need to start all over.

With a mortgage CRM like Shape, you own your own system and data, at all times. If you ever switch companies you can still use the same system with just a couple of changes like your email signature line and logo etc.

The best mortgage CRM should keep you because it’s the best product, not because you signed a contract. Month-to-month contracts and the ability to add users without having to commit to an annual contract, as well as the ability to reduce users if your business is downsizing can be a competitive advantage that provides solvency and flexibility to your team when it’s most needed, for you and your other offices.

Why should you, or anyone in your organization, pay for something you don’t want, need, or that doesn’t work for you?

A lot of mortgage CRMs also up-charge for additional services like using the phone system, or texting so you’ll want to make sure all features are included. Use of the features will always cost something (per text, or per minute, etc.) “usage costs” which is standard, but you want to make sure turning on the feature doesn’t add a monthly software fee in addition to these usage fees.

As a mortgage professional you want to spend your time on high ROI items, not on setting up software or dealing with CRM support issues. The type of support available is an important subjective consideration to make when selecting a mortgage CRM.

Here are some questions you should ask regarding support, and the answers for Shape’s Mortgage CRM below them:

Shape’s mortgage CRM is specifically built for mortgage brokers and is one of the most widely used systems in the industry.

Each account executive and support person at Shape has an average of 7 years of mortgage experience, which is industry-leading.

Yes, email support is available 24/7.

Most questions are answered within minutes, and it will never take more than 24 hours to get a response.

Yes, to both.

Shape offers weekly webinars, that can be accessed here: Live Training Webinars

Yes, all knowledge center materials can be found at: Support Guides / Knowledge Center

As one of the most complex and important pieces of technology for your business, it’s important you receive the proper training for your CRM software.

Are there free webinars?

Yes, weekly.

What type of video tutorials do you offer?

Over 100 videos.

No matter how many demos you do and how many questions you ask, you can never replicate the actual use of the system. That’s why looking at reviews online, and checking what awards/accolades each system has obtained (from third parties) is an important factor to consider when selecting a CRM. As of the time this article was published (October 2022), Shape’s reviews and awards include the following:

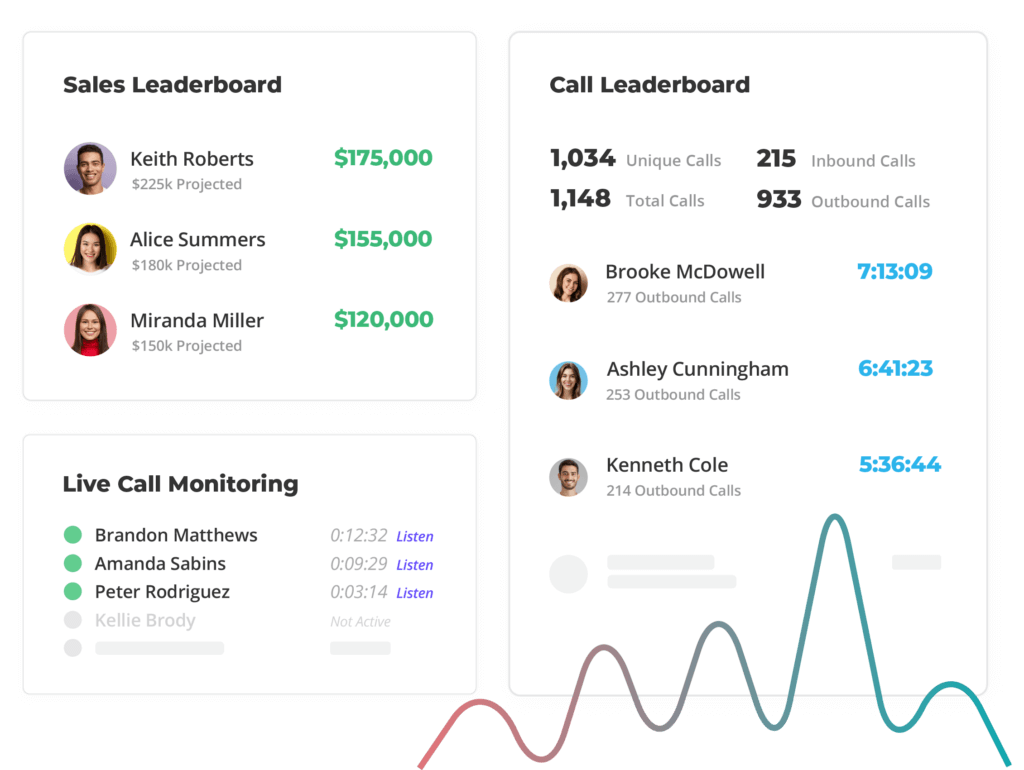

With billions of actions and items to track within a CRM, having the right reports, measurements, and displays to show you exactly what you want to know about your business is very important. Not only do you want to be able to customize your reports, but having the right ready-to-go reports can make your life and the improvement of your mortgage business much easier.

Managers also use business reports to track progress and growth, and identify trends or any irregularities that may need further investigation. In addition to helping guide important decisions, business reports help to build an audit trail of business activities.

Monitoring and reporting over time will not only highlight problems but can also identify opportunities for growth or expansion. Reports also work as a means of recording previous activities and help to define future growth opportunities by identifying already proven successes or what else could be done moving forward.

Performance Evaluation

Control and Monitor Team Members

Improve Communication

Enhance Performance

Compliance and External Reporting

Track and improve KPIs

Easily Track and Improve Sales

Automate customer reports

Track and evaluate customer communications

Custom Reporting

Create your own custom report templates based on any combination of criteria, with many formatting options so it’s tailored to your team and goals. You can create custom reports to pull data and analyze metrics, filter, group, sort & sum to get an overview of results, measure conversion rates throughout specific stages in the customer lifecycle, and monitor which sources, activities, or assets impact your lead generation, revenue, etc. Report output can be exported to another application and can be scheduled to send on a regular basis.

With Shape’s custom reporting capabilities, your business has the flexibility to analyze activity within your Shape account based on your reporting needs. You can create custom reports to:

Pull data to analyze single objects like contacts, deals, or line items

Filter, group and get an overview of results to reveal winning strategies or challenges for your team to overcome.

Measure conversion rates throughout specific stages in the customer lifecycle

Monitor which sources, activities or assets impact your lead generation

Measure which sources, activities, or assets have the greatest impact on revenue.

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.