Integrating these aspects into your CRM strategy not only streamlines your business processes but also sets a strong foundation for sustained growth and customer satisfaction. A well-chosen CRM system can truly transform your business.

All-in-one software for marketing, sales, customer service, CRM, and operations.

Share article

Fortunately, there are several equations that can help calculate it the ROI of CRM:

CRM ROI = (Gain from Investment into CRM – Cost of investment) ÷ Cost of Investment

According to the global tech analysis firm Nucleus Research, the answer to this equation is an average of $8.71. That means that, on average, CRM software returns almost $9 for every $1 invested.

What that also means, is that some companies get far better CRM ROI, while others aren’t getting a single dollar back. Of course, how much impact these systems have on your annual revenue will depend upon whether you’re using best practices, and efficient CRM implementation.

Put simply, it stands for Customer Relationship Management Return on Investment. It is calculated by taking the net return from your CRM investment (the total financial benefits minus the costs) divided by the cost of the investment, and then multiplying by 100 to get a percentage.

Typically, companies can expect to see a positive return on total investment from a CRM system within 12 to 18 months. However, this timeframe can vary depending on factors such as the size of the company, the complexity of the CRM implementation, implementation costs, and how effectively the system is utilized by employees.

CRM systems are pivotal in shaping business success. They streamline operations and enhance customer engagement, directly impacting your bottom line. Here’s how:

CRM tools offer a personalized approach to interactions, ensuring every customer feels valued and understood. Shape's mobile-optimized customer portal greatly enhances this process.

Centralizing customer data drives better business decisions and contributes to revenue growth.

Managing customer relations makes training more streamlined, allowing marketing efforts to focus elsewhere.

Identifies and engage potential customers, turning them into new customers through targeted marketing and personalized interactions. This enables you to close deals cost-effectively.

Consistent, excellent customer service retains customers, enhancing loyalty.

Automate and organize data entry, freeing up time for your marketing team to focus on crafting relevant brand experiences.

Track and manage every prospect interaction, leading to higher satisfaction rates.

Uses various modules to manage different business aspects, from sales pipeline tracking to marketing automation, ensuring cost savings.

Helps manage the sales process efficiently, from initial phone calls to closing deals.

Aligns sales estimates with actual performance, leading to increased revenue.

The long-term benefits like cost savings and revenue growth justify the initial cost of CRM investment.

Automates repetitive tasks within your marketing team, allowing them to focus on more engaging social media campaigns.

Identifies and nurtures potential customers, ensuring marketing strategies are directed at the right audience. Shape's cutting edge AI-driven technology analyzes customer data and forecast conversions.

Manages your sales pipeline to ensure no opportunity is missed and every lead is effectively pursued.

Mortgage CRM software helps manage client relationships, property details, and follow-ups, enhancing overall efficiency.

Integrating these aspects into your CRM strategy not only streamlines your business processes but also sets a strong foundation for sustained growth and customer satisfaction. A well-chosen CRM system can truly transform your business.

So what’s the difference between the companies who use nearly 10X their CRM ROI and those that end up sending their money straight down the drain?

The answer to that usually depends on two key factors:

Given the variation of formulas, it’s unlikely you’ll find one single CRM ROI calculator fit for all use cases. Fortunately, we’ve broken down the key basic formulas. We’ll show you several metrics that have a direct correlation with the ROI your company can get out of its CRM system, as well as which CRM features can drive that ROI even higher. Right, let’s take a closer look

It is for this reason that a good Mortgage CRM is now a necessity for gaining an edge over the competition. Any old CRM won’t work in this context, one specially equipped to handle borrowers and all the activities they'll engage in is by far the better option. So without further ado, let’s jump into this article on the best Mortgage CRMs to help optimize and grow your business.

One of the most crucial metrics driving business revenue is how well leads are converting into buying customers. Even a slight increase in conversion rate by 0.5% can yield thousands of dollars in increased revenue.

While it should be noted that average conversion rates vary across industries, there are two distinct lead conversion processes that your CRM can have a direct impact on: Speed to lead and lead nurturing.

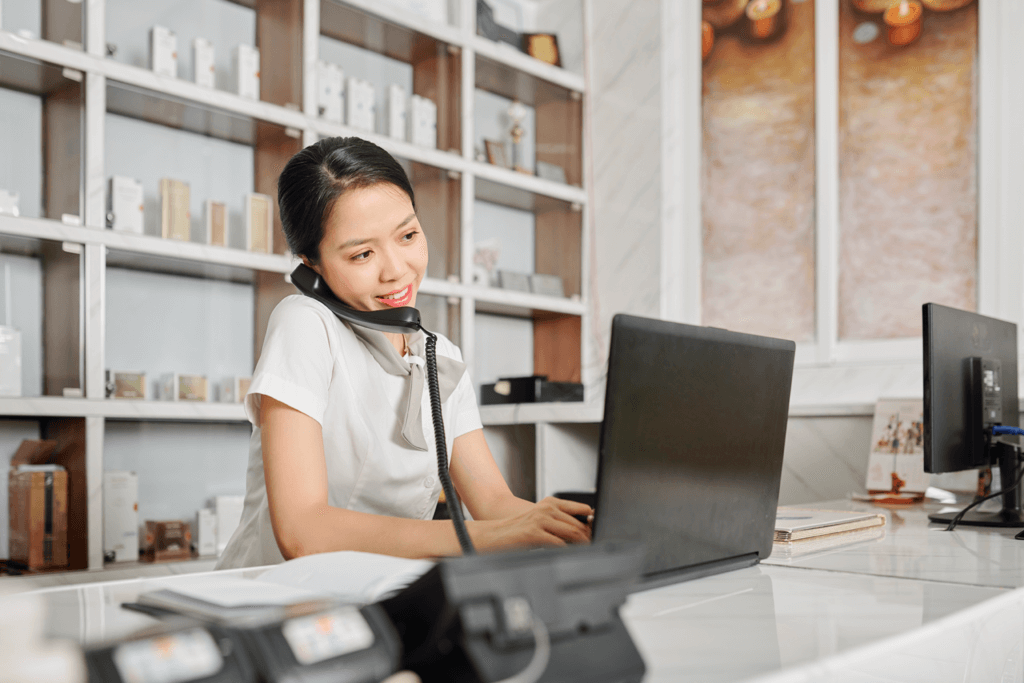

The speed with which sales reps contact their leads after their details are captured is everything.

According to an article published in Forbes and the Harvard Business Review, the chance of qualifying a lead when responding within the first five minutes is 21 times higher than when responding within 30 minutes. Despite that, only 26% of companies manage to respond that quickly.

Want to improve your speed to lead and make it to the upper echelon of leaders in your industry? Here are some of the key CRM features to look for:

Leads can come in through several sources, such as online forms, external marketing services, and even manual entries from team members. But no matter the source, there has to be a system in place that automatically assigns every incoming lead to the proper handler, whether it’s a sales rep, a loan officer, or an admissions counselor

Source. Shape users can access plug-and-play distribution rules for sales teams of various shapes and sizes. Instantly route incoming leads via Push (Round Robin) or QuickFire Connect to serve up new leads to the team members who can act the quickest.

It’s equally important to assign incoming calls to the right rep, to ensure your leads get instant access to the person who can solve their problem and move them one step closer to conversion.

Source. Inbound call routing can be set up directly within Shape according to your departmental, regional, and agent-specific sales strategies. For example, calls can be routed based on the caller’s state, source of the call, currently available agents, and other defining characteristics.

Even if all managers are currently occupied, no lead should be left hanging. A high-ROI CRM will route the call to other free agents, and/or set up a custom voicemail message to reassure clients that they dialed the correct number and will be contacted soon.

Source. Make sure every lead has the option to leave a message in cases where agents are too busy to answer or a lead is reaching out after hours.

Next to speed to lead, robust lead nurturing can also have a massive impact on your conversion rates.

There is no shortage of strategies for improving your lead nurturing systems. Among the most critical and often neglected ones is consistent follow up. Studies show that the majority of prospects say “no” four times before they say “yes”. At the same only a handful of salespeople initiate the fifth contact.

Even if all managers are currently occupied, no lead should be left hanging. A high-ROI CRM will route the call to other free agents, and/or set up a custom voicemail message to reassure clients that they dialed the correct number and will be contacted soon.

Let’s talk about some of the features your CRM should have to empower your reps to consistently follow up on the leads you’re giving them:

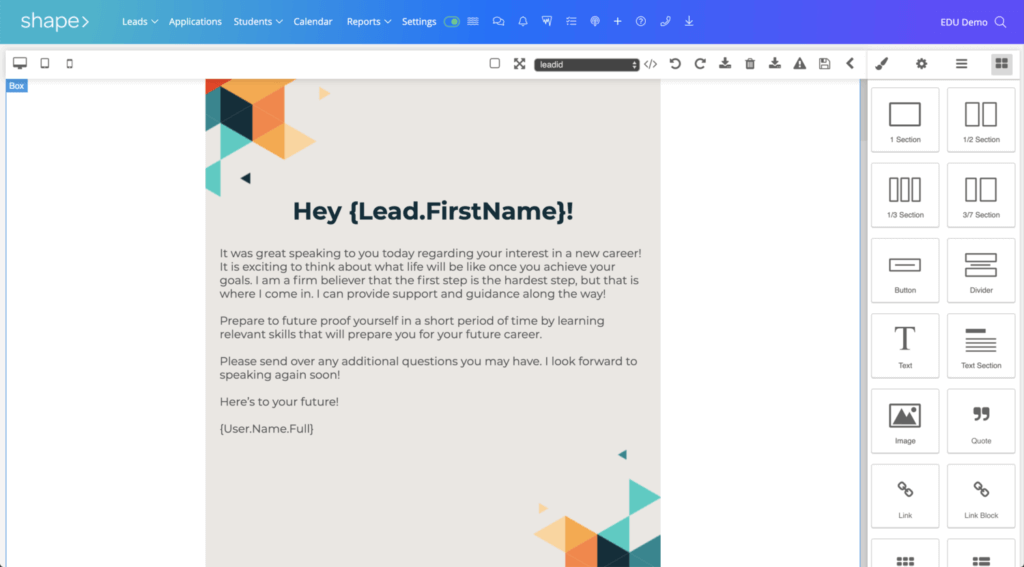

If your software supports drip campaigns, you can automate entire follow up sequences around pre-built emails and SMS templates. No sequence fits all cases though, so make sure your CRM offers customization options that make it easy to determine who receives what message and when.

Source: Shape users can automagically trigger or end a drip campaign by simply updating a lead’s status based on their last convo. It’s that simple.

One of the most overlooked parts of the lead nurturing process is making sure no lead ever slips through the cracks. If you don’t have a plan for leads that were assigned to a rep but poorly nurtured (or not processed at all), you’re effectively leaving money on the table and killing your ROI. In order to prevent large losses in potential revenue, look for a CRM that provides features for storing, tracking and re-distributing assigned leads that haven’t resulted in a successful transaction.

Outbound voicemails are a powerful technique that allows companies to warm up their leads before the actual call or revitalize old records without direct participation of managers. It can be combined with automated follow-up features or improve your average lead response time when your managers are overloaded with incoming leads and can’t respond personally.

Average increased conversion rate = SUM {Increased conversion rate across all lead sources } / Number of lead sources

Number of leads per month from Source 1 * Increased conversion rate for source 1 = Increased number of closed leads per month for source 1

The average amount of leads from all sources for Company X is 2,000, with an average conversion rate of 2% for a total number of closed leads per month of 40.

Company X uses a CRM solution with lead nurturing features and the average conversion rate across all sources increases by 0.5%, boosting the number of closed leads per month by 10.

With an average revenue per lead of $500, the company’s monthly revenue grew by $5000. Given the monthly cost of a CRM solution per 5 users is $495, the ROI is around 1010%.

Revenue per lead is directly tied to the overall revenue and there are many ways these software can help push that number higher:

A smart CRM organizes your entire sales databases including new leads and existing customers. With better lead segmentation, reps can offer relevant information and services to the most responsive groups of customers and leads to better match discounting policies, provide new services to existing customers, and get better ROI on every contact in your system.

A major factor here is how flexible your CRM system is and how closely it can be customized to support industry-specific sales strategies.

For example, Shape users can automatically review new prospects and score leads based on a company’s sales KPIs, or any other specific parameters.

Unfortunately, many CRMs do not play well with other systems. That’s especially true for all-in-one systems that claim to do everything from building your website to managing client retention and built-in systems that are added in as an afterthought to your existing management system, for example your Student Integration Systems (SIS) if you’re in the education space or your Loan Origination Systems (LOS) if you’re in the mortgage space.

Shape’s bi-directional integrations ensure that lead communication continues after leads are converted into customers, increasing the lifetime value of every contact in your database.

Some services are invaluable in creating deeper connections with leads and customers.For example, BombBomb is a video tool that allows reps to embed personalized videos into any message, dramatically increasing lead and customer engagement. With the right integration, you can weave video functionality directly into any of your sales workflows, such as drip campaigns, automated emails, or even a quick happy birthday message to leads and customers.

Another way to ensure the highest quality of service across all your organization is to actively use relevant email and text templates to help onboard new reps and ensure that even your less experienced sales agents always know what to say to keep leads engaged.

Around experience being transferred from agent to agent without any resolution to their problem. It’s crucial that your system supports a wide range of collaboration tools to make it easy for each type of user to see all the info they need to see, and none of the info they don’t. Now your customers are happy and your reps have everything they need to be able to retain and upsell your contacts.

Revenue per lead = (Amount of New Revenue Brought By Leads [per quarter] / Number Qualified Leads [per quarter])

Company X spends $99 per employee per month for access to their CRM.

There has been an increase in closed leads by 5 additional deals per month, with an average deal size per lead at just $100, Company X yields 505% ROI on the CRM.

Revenue per lead increased by $40 for Company X. Previous revenue per lead was $100 and new revenue per lead is $140.

If the average monthly number of leads per employee is 30, then the total revenue by employee is increased by $1200.

If the cost of CRM is $99, the ROI is 1212%.

On average, employees waste 55% of their time on administrative tasks—and sales reps are no exclusion.

The good news is these software can automate the majority of your team’s routine actions, potentially saving hours, days, or even weeks that can be better spent on revenue-generating activities like active prospecting.

Here are two core features every CRM should have for effective automation:

Integrations are crucial for automating mundane administrative tasks to make sure your reps and admin have more time for their most high impact work. Direct integrations with the tools your reps already use and love keeps them from having to switch between several different applications so they can stay focused and perform all their tasks from one central system.

Triggers are the heart of every automation. Based on predefined events, triggers launch a series of actions that lets you automate the communications and productivity aspects behind every workflow.

The amount of saved hours * $ per hours = $$ saved

OR

The amount of time saved / Time Spent Closing Lead = N more closed leads

When it comes to marketing ROI in the digital age, true power comes not from the data itself, but from the cohesive data. You can look at Google Analytics graphs and Facebook interactions all day long, but if the numbers aren’t connected to the right business processes in your company, you’ll never be able to actually apply those insights.

For optimal ROI, look for CRMs that provides advanced reporting so that you can connect the dots between lead sources, agent performance, and conversion rates. With the right data in hand, you’ll have everything you need to make informed decisions about your marketing strategies, all in one place.

Reduce M, increase N

If your average marketing campaign costs are $5,000 per month and you reduce the amount of ineffective campaigns by 30%, with a CRM cost of $495 for 5 team members, this yields potential ROI returns of 303%

The process of enhancing sales team performance never ends, but it should always start at the heart of your sales system: your CRM.

Now that you know how many revenue opportunities you can snatch up with the help of modern Customer relationship management, it’s time to put your systems to work to get the best possible return on investment. At the end of the day, simply installing a system and telling your reps to use it won’t cut it.

After years of helping our customers get the most value for their money with Shape, we’ve come to a simple conclusion:

If your CRM doesn’t provide value within the first 2 weeks of its implementation, it’s probably not the right fit. We know how hard it can be to try something new and want to make the process as smooth as possible so you and your team can start seeing more ROI asap.Get started with a free 14-day trial of Shape and see for yourself how the right CRM can bring back every dollar you put into it, multiplied.

In this article, we asked 5 of the top experts in the real estate and mortgage industry the following three questions and this article is the result!

1. What strategies or tactics have you seen implemented that significantly improved mortgage businesses?

2. What are the most common mistakes you see mortgage companies make?

3. What advice would you give mortgage businesses in today's market?

Katherine has over 20 years of marketing, digital promotion, and technology experience on a national and global scale.

Katherine Campbell

Chief Marketing Officer for AnnieMac.

The most important consideration today in mortgage technology is to understand that there are two journeys we are creating for companies. One is the journey of the consumer and the other is for the loan officer. They use the same tools for very different reasons. Additionally, the executive team needs the BI out of these tools to consider not only the ROI from them, but where in the process a borrower may drop out of the funnel. The strategy I implement is an end-to-end fully integrated solution with SSO (single sign ons) for both journeys. A borrower may end up touching 11 technologies from web analytics to ratings and reviews, but it should feel like one seamless, simple solution.

The most common mistake mortgage companies make is allowing departments to review and select their own technology. Most department managers do not have the experience to understand the scope of integrating technology nor the consequences of not. Additionally, to please people, management has often allowed multiple products with redundant capabilities. This creates segregated data, a break in the workflow, and multiple logins. Tools like Shape, the all-in-one business management solution, are new contenders in our industry and help tremendously with aggregating content, workflow, data, and above all – expense! All company technology should go through a vetting process with a CDO or CTO.

Don’t ignore the inevitable in this tough market. We are all digital clients in every other industry. We do not drive around looking for a travel agent office to buy plane tickets with our checkbook. Many companies are stepping up, even in the midst of this economy. They are re-building or ramping up their digital solution with tools like Shape and a bot like Botsplash which has a Chat GPT experience already built-in. If you stay stagnant, or if you let your contracts expire, you will not be behind the times when the market picks up again – you will be left in the dust.

Eliot is Managing Director and Chief Investment Officer of Nobel Partners. He has invested and managed over $10 billion of assets over his 20-year career.

Eliot Saeedi

Managing Director, Nobel Partners

Here are my top three:

1) Set up your triggers and automation - Businesses that take the time to set up their software with the right automation will always outperform businesses that spend more time trying to “outwork” their competitors. Set up your text, email, and call cadences within your CRM to make your life easier.

2) Focus on referrals - Referrals will always be your best bet for high quality business. Referral tracking, co-marketing, and referral updates are vital to pull through as much referral business as possible.

3) Use a Borrower Portal or POS - Mortgage businesses that use a digital 1003 or client portal are able to convert more loans and shorten their closing cycle. Using software to handle the tedious task of gathering information and documents lets mortgage businesses focus on what they should be doing – talking to more potential borrowers.

I’ve seen mortgage businesses spend hundreds of thousands of dollars on bringing leads in, they close what they can and the rest basically goes in the trash. After referrals, remarketing is always going to have the highest ROI of any of your marketing efforts and using text and e-mail automation to remarket them is the most efficient way to scale any real estate or mortgage operation.

Focus on conversions not volume. In today’s market, mortgage volume, purchase and refi business has all been turned on its head. Instead of looking outside for more leads, focus internally to convert better. Using tools like Shape’s Lead Engine allow you to close more loans and increase your revenue with the same (and sometimes even less) lead volume.

Mike is a Certified Mortgage Banker (CMB) with the Mortgage Banker's Association with 20 years of mortgage industry experience and is the former CMO of Mr. Cooper, the country's largest non-bank servicer.

Mike Eshelman

Former CMO of Mr. Cooper

Over the years, I’ve had the pleasure of getting a behind-the-scenes look at many lenders’ marketing teams, and what I’ve noticed separates the really successful ones from the rest of the pack is clean reporting. Knowing which marketing campaigns are delivering a positive ROI and which are not is critical to success. Especially in a volatile rate environment, being able to identify which campaigns to scale and which to scale back can make the difference in being profitable and growing your business or being stuck in a rut (or worse!). My advice is to take the time to get reporting right and understand which campaigns and customer segments are best for your business.

Through Verse, David’s mission is to help companies thrive by connecting with prospects and customers through AI-powered texting.

David Tal

Co-CEO of Verse.io

A campaign can live or die solely based on script design and optimization. It’s one of the most important and overlooked aspects of lead conversion. Not only do we A/B test for phrasing and messaging, but for types of questions, response rates, opt-out rates, qualification rates, and many other variables.

The difference between a poorly designed campaign and one that has been professionally designed and optimized can sometimes double conversions. It’s that important.

Another huge factor in increasing conversions, and it’s not sexy, is due to building out our carrier relations team. Deliverability and compliance are non-negotiables when trying to scale two-way SMS campaigns and direct contact with the carriers to ensure messages are getting through is crucial.

A lot of mortgage companies are falling behind in adopting marketing and sales automation. While other industries have embraced automation in lead generation, CRMs, and marketing, there are still a lot of mortgage companies doing things manually or in outdated ways.

New leads are being routed to humans who do manual outreach or the engagement automation is one-way and basic. The technology for sophisticated consumer engagement is out there, but the mortgage industry has only recently begun leveraging it.

Be patient and stick to your plan even if you have to slow down and cut costs. If you have created something of value, the headwinds will become tailwinds.

Also, respect and promote consumer choice in your marketing funnel. People who inquire about getting financing may just need advice and may not be ready to enter the market. Be grateful they inquired with you, be kind and curious about their goals, and create a path via automation and personal outreach to help them make an educated decision when the time comes. You’re planting seeds, so make sure you nurture them in a way that will help you both grow.

Luke is the co-founder and CEO of Clever Real Estate, the nation's leading real estate education platform for home buyers, sellers, and investors.

Luke Babich

Co-founder and CEO, Clever Real Estate

The crux of what we do at Clever is give Lenders the tools, technology and relationships they need to win in a purchase market: to retain their buyers, increase their profits, and achieve their goals.

The starting point for that is our Agent Matching Platform, or "AMP": we give Lenders a platform through which they can match their buyers up with vetted Lender-Certified Realtors anywhere in the country.

We put these realtors through a certification program before they can receive any clients from our partners, and then we hold them accountable to documented standards and performance scorecards to stay in the program. They're expected to provide regular updates and deliver exceptional service to both the client and the loan officer.

When you give Loan Officers the ability to tap into a vetted, reliable and personalized realtor match for every buyer — in any local market where they have a client! — it gives Loan Officers radically greater flexibility to build relationships and grow their pipeline.

With that foundation in place, we add unique analytics and marketing capabilities to help lenders capitalize on the ability to monitor and manage the entire buyer journey through our realtor network.

There are two main mistakes we see lenders making — or to look at it from the flipside, there are two things that we see lenders do right that help them succeed even in this tough environment.

First, successful lenders own a niche.

The most common mistake we see is trying to be all things to all people. Buying any lead you can. Marketing through every channel you can. Chasing after every realtor you can.

The most successful lenders we work with pick a niche to focus on. Maybe it's the lower-priced USDA loans that other people overlook. Maybe it's finding investors who can help them offer a unique product alongside their FHA loans, that is a perfect solution for a specific set of consumers they want to serve.

Second, successful lenders focus on relationships before transactions.

The second common mistake we see is taking a short-term, transactional mindset to managing the business. This was especially easy to do in the heady refinance boom of the last two years — but the party has a rough hangover for those who didn't manage their business with a long-term view.

The most successful lenders we work with focus on getting their Loan Officers the tools and solutions to nurture and retain their relationships — not just focusing on getting more leads in the door, or recruiting more loan officers. Companies that provide their originators with solutions that help them convert better and build better relationships have an enduring competitive advantage in any market conditions.

There is not a choice between technology and relationships. You need to excel at both. Many companies tried to automate human connection out of the real estate process — and it failed.

But many others are relying on the old ways of building relationships that worked 15 years ago, before buyers learned that they can research mortgage rates online, or came to expect instant responses to text and phone calls around the clock.

Lenders need great technology infrastructure to deliver great relationships in a digital era, when so much of our communication and collaboration has gone remote. Clever offers one part of that: a platform from which to manage realtor relationships and control the home buyer journey. But we're just one piece of the puzzle. Lenders also need CRM tools that help them capture data from their sales process, and roll out new processes and best practices effectively across an entire team.

The lenders who succeed are not afraid of driving process change within their team. Loan Officers often resist new technology, new tools, new processes. That's natural. But lenders who create the buy-in within their teams to overcome that resistance will adopt technology and improve faster — and come out on top of the pack. Relationships matter inside your company, as well as out in the market.

Select the most convenient time for you, and leave the rest to us! Meanwhile, please take a quick look at the 3-minute demo of Shape to discover its capabilities.

Be the first to reach prospects with automated email, text, and phone sequences. 1,000+ pre-built templates ready to deploy.

Use Shape’s digital 1003 application and secure borrower portal with Shape’s powerful automation to close more loans.

Integrate with your favorite LOS to automatically sync your LOS data with your CRM and automate e- mails, texts, and calls to optimize pipelines.

"*" indicates required fields

Score leads based on interest level, engagement history, and patterns. Prioritize activities based on time-sensitivity & value.

Auto-assign leads to agents based on loan officers licensure, location, and availability.

Make calls with 1-click and automatically log them to the CRM. All-in-one interface. No new hardware required.

Store old or neglected leads in a shared contact pool. Sales reps can quickly access and create new campaigns.

Automatically follow up with leads via email & text. Get the 17 touch points you need to win a client.

1,000+ mortgage-specific templates. Email, texts, posters, and more. High converting. Ready to send.

Populate documents with signatures in seconds. Eliminate lengthy manual signing processes.

Secure hub for borrowers to complete loan applications, upload legal documents, and more.

Automatically request relevant documents based on customer answers in loan applications.

Send automated email & text reminders to borrowers to keep application moving. Plus loan status updates keep them informed.

Integrates with all major LOSs. Includes encompass, Lending Pad, Lending Docs, Calyx, Mortgage Coach, and more.

Integrates with 5,000+ apps, including Google Workplace, Microsoft 365, and Calendly.

Increase in Sales

Faster Sales Cycle

Saved per Month

Chris W. Mortgage Loan Officer

Source: Shape G2 reviews

Select the most convenient time for you, and leave the rest to us! Meanwhile, please take a quick look at the 3-minute demo of Shape to discover its capabilities.

Be the first to reach prospects with automated email, text, and phone sequences. 1,000+ pre-built templates ready to deploy.

Use Shape’s digital 1003 application and secure borrower portal with Shape’s powerful automation to close more loans.

Integrate with your favorite LOS to automatically sync your LOS data with your CRM and automate e- mails, texts, and calls to optimize pipelines.

"*" indicates required fields

Score leads based on interest level, engagement history, and patterns. Prioritize activities based on time-sensitivity & value.

Auto-assign leads to agents based on loan officers licensure, location, and availability.

Make calls with 1-click and automatically log them to the CRM. All-in-one interface. No new hardware required.

Store old or neglected leads in a shared contact pool. Sales reps can quickly access and create new campaigns.

Automatically follow up with leads via email & text. Get the 17 touch points you need to win a client.

1,000+ mortgage-specific templates. Email, texts, posters, and more. High converting. Ready to send.

Populate documents with signatures in seconds. Eliminate lengthy manual signing processes.

Secure hub for borrowers to complete loan applications, upload legal documents, and more.

Automatically request relevant documents based on customer answers in loan applications.

Send automated email & text reminders to borrowers to keep application moving. Plus loan status updates keep them informed.

Integrates with all major LOSs. Includes encompass, Lending Pad, Lending Docs, Calyx, Mortgage Coach, and more.

Integrates with 5,000+ apps, including Google Workplace, Microsoft 365, and Calendly.

Increase in Sales

Faster Sales Cycle

Saved per Month

Chris W. Mortgage Loan Officer

Source: Shape G2 reviews

Select the most convenient time for you, and leave the rest to us! Meanwhile, please take a quick look at the 3-minute demo of Shape to discover its capabilities.

This is what we call a “loaded listicle.” Why? Because we can’t be certain what status your life is currently in and if you actually want to change it, but we’re going to assume that if you are a legal professional and you’re not using Shape’s Legal CRM – you’re most likely miserable.

Without a cloud-based Legal CRM to manage your law firm’s day-to-day activities, misery ensues. End costly bouts of misery. Change your life with Shape’s business cloud software specifically designed for law firms.

On any given day, law firms are managing all or most of these (and so much more):

Multiple marketing and email campaigns

Leads and their sources

Client intakes

Client communications via phone, text, and email

Documents and more documents

Calendars, court dates

Third party providers

Invoicing

Without a cloud-based Legal CRM to manage your law firm’s day-to-day activities, misery ensues. And when your prospective clients fall through the cracks because you’re busy trying to manage the other details, well, your marketing just became a moot point. That’s expensive.

End costly bouts of misery. Change your life with Shape’s business cloud software specifically designed for law firms. Request your free trial. But you did read this far, so…

Manage Your Sales and Marketing with real-time automation that integrates every point of contact as it occurs. No more redundant data entry and no more employee error, but most importantly, no more prospective clients falling through the data cracks.

Streamline the Intake Process with online forms and form builders, built-in e-signatures, and file attachments. Integrates with Needles or Clio for a truly innovative and integrated process.

Communicate How Your Client Listens, via phone, email, or text and keep a record of every point of contact.

Manage Deadlines and Calendars including Statutes of Limitations with Shape’s interactive cloud software and eliminate costly errors.

Manage Documents and Records, including third party sources. Maintain all your records in the right files, every time, and assign customized permissions to the firm for transparency, accuracy, and efficiency.

Manage Billing as if you were born into a family of accountants. Track time and expenses, create and track invoices, monitor online client payments, gather financial reports and more.

Whether you’re venturing off from partners or fresh out of law school, every new law firm needs the same two tools to compete in today’s market: the right software and the right processes.

For every bar complaint made by clients about lack of communication from their attorney, there is a firm creating a seamless and high-touch experience without doing any heavy lifting.

Ever misplaced a client’s information in a pile of paperwork on your desk? Forgot to follow up after you sent out an intake form? These are everyday mistakes we all make as busy attorneys. The problem is that without proper data and workflow management (AKA “process”), we leave ourselves exposed to hiccups that can cause major disruptions to our business (AKA cash flow).

Process is much more than how you think a new DUI client or probate case: it’s documenting and implementing it in a way that becomes easily repeatable for anyone. Great process documentation means fewer errors, happier clients, and a lot of time saved.

New client inquiries

Getting documents sent, signed, and received

Assigning tasks to your support staff

Billing and payments

Managing a client’s case work and data

Marketing, client updates, and seeking referrals

And the list goes on…

As lawyers, we are no strangers to the galaxy of specialized software catering to us, promising to make our lives easier, better, shinier. The reality is, not every tool is needed for your law firm. Racking up a ton of monthly subscription fees isn’t exactly the best way to launch a new law firm.

Instead of stringing together a bunch of disparate tools, we recommend that new and growing law firms adopt a powerful and complete CRM solution for a variety of reasons:

– create workflows for all the processes we mentioned above to keep you consistent and your clients happy

– you don’t need a tool for e-signature, documents, billing, intake, marketing, and more – a good CRM combines all those in one package

– 65% of law firms who use a CRM meet or exceed their sales and revenue forecasting – starting out with a CRM as your firm’s backbone gives you this advantage

Build and send custom intake forms, generate fee agreements or contracts with e-signature, send invoices, and accept online payments. All documents seamlessly sync to your client’s matters, so you always have a paper trail.

Assign tasks to your support staff, automate case status updates via SMS/email, log client communications, and keep all your client details in one secure place.

Provide a secure portal where clients can log in, upload documents, check on their case status, review your policies and procedures, and take care of essential admin (all from their phone or desktop).

Streamline your email communication with in-depth email & SMS drip campaigns, nurture leads to higher conversion rates, and keep your clients in the loop.

Schedule appointments in a click and send automated appointment reminders, so your leads and clients never miss a meeting with you again. Make the most of every billable hour!

Interested to learn more about how you can implement these (and many more) features of a CRM for just $79 a month?

Remember the days when you could fill your enrollment quotas by inviting a group of parents and high school seniors to your campus and then sending out flyers afterwards?

Those days are long gone.

As students become more and more selective with the colleges they choose, a college recruitment strategy is an absolute must. And if you don’t want to become a part of the 63% of colleges that didn’t meet their enrollment goals

in 2019, that strategy has to be sustainable.

This article covers the 5-point plan that will help your higher ed organization immediately attract and convert more students in the upcoming year.

But before we dive in, let’s define what a college recruitment strategy is!

A college recruitment strategy is a set of workflows and processes that you can easily scale to enroll quality students and fulfill your admissions goals.

Simply put, if your college doesn’t have a college enrollment recruitment strategy, you’re probably shooting random marketing messages in the dark, hoping that prospective students will read them and come knocking on your door.

If you want to meet your enrollment goals, you need a marketing message that is both very specific, and able to stand out in a highly competitive market where students are constantly being bombarded with messaging. A college recruitment strategy makes that possible.

While every recruitment strategy depends on the institution and the recruiters themselves, our 5-step framework will help any student recruiting team better identify their perfect target audience, create a convincing and powerful message, and make the student enrollment process way more efficient.

Here’s how it works.

Step #1: Create Detailed Student Personas

Step #2: Coin Your Marketing Campaign Message

Step #3: Define Underused Marketing Opportunities

Step #4: Train Your College Recruitment Staff

Step #5: Analyze Performance Data And Enhance Your Enrollment Strategy

The easiest way to make any marketing message convincing is to address it to the right person at the right time.

As a higher education organization, you likely already know who your students are. Student personas help you take that knowledge to the next level.

Student personas are semi-fictional archetypes that represent a segment of the target audience you want to enroll in your university.

Personas can be anything from “a senior high school student interested in math” to something much more specific and tailored.

Typically, the more detailed your student personas are, the better you can understand the core needs of your prospects and develop specific marketing campaigns that resonate with them.

Survey current students. Conduct polls and surveys among current students to understand how they learned about your organization and why they chose your college over your competitors.

Research and analyze current enrollment data. Integrate your learning management software with ahigher ed CRM to gain insight about your best performing students and how they were recruited.

Create several personas. Don’t restrict yourself to a single persona, as all students are different and enroll for plenty of reasons. Try creating several personas to refine and implement over time.

From GPA to areas of interest, a detailed student persona tells you exactly who you’re looking for to the point that your marketing messages practically write themselves!

To create effective marketing campaigns you have to account for several things at the same time. Below are some of the most crucial factors to a successful college recruiting strategy.

The field of higher education as we know it is becoming more and more competitive with every passing year. Digital education platforms are growing by the day, while thousands of colleges are offering attractive online programs as alternatives to brick and mortar education.

In many ways you’re no longer competing with a handful of organizations in your city— you may be competing with the whole world.

That’s why it’s important to identify your main competitors and analyze their marketing strategies as soon as you have some student personas to work with. If you decide to advertise blindly instead, you risk burning through your whole ad budget trying to compete with organizations that are saying very similar things.

After you’ve identified your competition and their strategies, consider creating a perceptual map to use as a guide for future reference and further analysis.

While both product-level marketing and brand marketing play integral roles in helping institutions attract more students, it’s important to be able to discern between the two. Brand marketing includes messaging that makes you unique compared to your competition, while product marketing’s main goal is to inform your prospects about your product and how it can help them.

Actively use your student personas. Your student personas should be tightly connected with your marketing messages. Personas help make marketing messages more targeted, which leads to better results.

A/B test your marketing campaigns. No one can create a perfect message from scratch. Fortunately, every major marketing platform (Facebook Ads, Google Ads, landing page conversion software, etc.) allows you to A/B test your marketing messages and select the best performing ones.

Eliminate department silos. Different units within your organization can have their own marketing campaigns and compete for the same student personas. Collaborating instead of competing can make everyone’s marketing strategy more efficient!

Now that you’ve successfully created and tested your marketing message, it’s time to boost your applicant rates by identifying new marketing opportunities.

Often the best way to outmatch your competition and enroll more students is to engage students where your competitors aren’t.

Try new marketing mediums. New platforms are emerging every year. A few years ago Instagram and Snapchat were all the rage. Now it’s all about TikTok and other platforms. When your competition is wary about marketing on new platforms, you have a golden opportunity to command the market.

Try new marketing formats. Traditional campus recruitment events have been around for ages, and although face-to-face interaction is a powerful form of communication, there are other marketing channels to consider. Augmented reality, virtual tours, and live streams can present great platforms to engage students in new, original ways.

Find new ways of gathering data. The more data you have on your current students and organization as a whole, the more you’ll be able to determine which recruiting strategies will work. Investing in quality CRM platforms can help you maintain, track, and analyze relevant data quickly and efficiently.

Once student applications and inquiries start coming in, untrained recruiters can quickly become a bottleneck.

Ask yourself:

Do my recruiters reply to all inquiries in a timely and professional manner?

Do they consistently follow up on all applicants to keep them engaged and interested?

Are they utilizing several messaging mediums to boost open and reply rates?

Provide adequate recruitment staff training. Online sales programs, webinars, and invited experts will enhance your staff’s ability to convert inquiries into applications.

Use recruitment templates and scripts. Shape EDU CRM provides recruiters with well-tested recruitment templates for email, text, and phone calls. The templates were created based on several years of exclusive partnerships with leading EDU organizations such as Woz U and SCI.

Actively use automation. With smart lead distribution and automated email campaigns, you can reduce response times to seconds and consistently reach out to prospects when they’re most likely to respond.

After you’ve gone through the whole recruitment funnel—from student persona ideation to the finished application—you’ll need to look back at your strategy and analyze what worked for you and what didn’t.

This is a critical stage of every enrollment strategy, because it allows you to optimize and improve your results in several ways. When you analyze your performance data, you can:

Enhance your student personas. The more students you enroll through the use of student personas, the easier it will be to determine which personas are accurate, and which still need some work.

Remove operational inefficiencies. Enrollment is a long-play game, and the more you can optimize your daily processes, the more resources you’ll be able to save in the long run. With data in hand, you can gather feedback from your recruiters, eliminate department silos, and make sure your recruiters leverage technology to reduce routine tasks and focus on recruitment.

Learn your numbers. Analyzing your data will help you make sense of your applicant rates, acquisition by channel, and any performance metrics you need to facilitate decisions in the future.

A college recruitment strategy is not a one-off solution that you create and follow for years.

To ensure your enrollment strategy stays relevant, keep a live document where all your team leaders can access it and make relevant updates. An updated college enrollment strategy allows your team to adapt to the shifting preferences of your target audience, and saves you time, money, and effort on strategies that don’t work.

If you want to gain a competitive edge in the current higher education landscape, investing in the right systems can also be a huge help.

Read more about how Shape comes out on top among the best CRMs for higher education.

Changing templates will take time and may require a template change fee.

Not sure what to choose? Contact us.